Financial Models: Your Blueprint for Business Growth

Let’s delve deeper into why financial modeling is far more than just intricate number crunching—it’s a critical tool for steering your business towards sustained success. Imagine you’re plotting a road trip across the country. You wouldn’t just rely on guesswork for your route; instead, you’d probably use a GPS or map app to plot your course, check for traffic snags, and schedule stops. Financial models function similarly for your business, providing a detailed map of your financial journey, helping to predict bumps along the road and ensuring you’re prepared for them.

What is a Financial Model?

A financial model is essentially a tool built mostly in spreadsheets that helps a business forecast its future financial performance based on historical data, assumptions about the market, and an analysis of various financial metrics. It’s like a roadmap for your company’s finances, guiding strategic decisions, investment opportunities, and other business moves.

Think of a financial model as the skeleton that holds up the body of your business strategy. It combines income statements, cash flow statements, balance sheets, and other financial information to provide a complete picture of your company’s current and future financial health. This model helps businesses make informed decisions, anticipate future revenues, manage cash flow, and gauge the potential impact of strategic decisions on profitability.

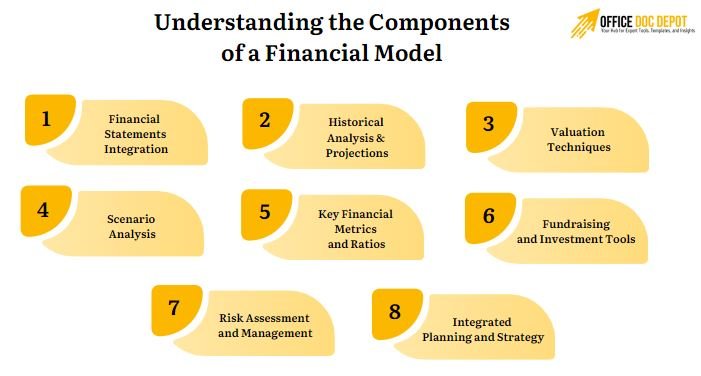

Understanding the Components of a Financial Model

Creating an effective financial model involves several crucial elements, each playing a pivotal role in ensuring the accuracy and usefulness of the model for decision-making, investment analysis, and strategic planning. Here’s a breakdown of these components:

1. Financial Statements Integration

A robust financial model typically starts with the integration of the three major financial statements:

- Income Statement: Reflects the company’s financial performance, showing revenue, expenses, and net income over a specific period.

- Balance Sheet: Provides a snapshot of the company’s financial standing at a specific point in time, detailing assets, liabilities, and equity.

- Cash Flow Statement: Offers insights into the inflows and outflows of cash, highlighting how well the company manages its liquidity.

2. Historical Analysis & Projections

Financial models use historical performance data to establish trends and inform projections. This includes:

- Historical Performance Analysis: Examines past financial data to understand trends and variability in revenue, costs, and other key metrics.

- Financial Projections: Forward-looking estimates such as revenue growth, expense projections, and earnings forecasts, helping in setting realistic financial targets and preparing for future financial needs.

3. Valuation Techniques

These are used to estimate the business value based on its financials and potential for future earnings, crucial for fundraising and investment banking scenarios:

- Discounted Cash Flow (DCF): Calculates the present value of expected future cash flows using a discount rate

- Comparable Company Analysis: Benchmarks against similar companies to estimate business valuation.

4. Scenario Analysis

This includes various forms of testing different financial outcomes based on varying scenarios:

- Sensitivity Analysis: Examines how changes in key assumptions impact financial outcomes, helping identify potential risks.

- Stress Testing: Assesses the resilience of financial models under extreme financial conditions.

5. Key Financial Metrics and Ratios

Essential for financial analysis, these metrics help assess the financial health and operational efficiency:

- Cash Flow Analysis: Tracks liquidity and cash reserves to ensure the company can meet its short-term obligations.

- Financial Ratios: Such as debt-to-equity, ROI, and profitability ratios, which provide quick insights into financial health relative to industry norms.

6. Fundraising and Investment Tools

Financial models are integral to the fundraising process, providing potential investors with insights into the company’s financial stability and growth potential:

- Investment Return Projections: Show potential profitability of investments, helping attract and persuade investors.

- Capital Structure Analysis: Offers strategies on how to balance debt and equity to optimize a company’s financial structure.

7. Risk Assessment and Management

Identifying and managing potential financial risks using modeling techniques ensures the company can withstand financial stresses:

- Churn Rate and Conversion Rates: Critical for understanding customer retention and profitability in models, especially for startups and technology companies.

- Cash Balance Maintenance: Ensures there are enough reserves to handle operational needs and unexpected expenses.

8. Integrated Planning and Strategy

Models align financial goals with business strategy, supporting long-term strategic planning efforts:

- Budgeting Processes: Help in allocating resources efficiently.

- Financial Planning Software: Facilitates more dynamic and integrated financial planning.

Each component of a financial model works in tandem to provide comprehensive insights into a company’s financial trajectory, offering stakeholders a detailed view of past performances, present conditions, and future prospects. This not only helps in making informed strategic decisions but also in securing a solid financial future.

In sum, a financial model isn’t just a set of spreadsheets with numbers—it’s a strategic tool that encapsulates your business’s financial narrative. It aids in making grounded, foresighted business decisions, helping steer the company toward financial stability and growth. For any business from startups to established enterprises, a well-crafted financial model is indispensable for navigating the complex waters of today’s business environment.

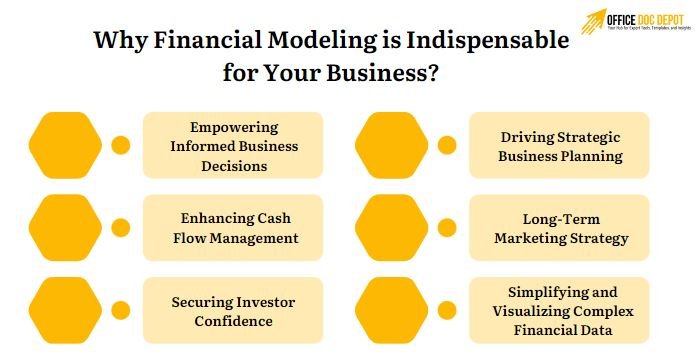

Why Financial Modeling is Indispensable for Your Business?

Empowering Informed Business Decisions

Financial modeling serves as your business’s foresight mechanism, allowing you to anticipate financial outcomes before making key decisions. Whether you’re contemplating expanding your market reach or adjusting your business model, a comprehensive financial model uses historical data and forecasting. It simulates various outcomes based on this information. This isn’t merely speculative. It’s a strategic approach akin to using predictive analytics to weather forecast. It ensures you’re prepared for the financial climates ahead.

Enhancing Cash Flow Management

Effective cash flow management is crucial, and financial modeling offers precision tools that act like a financial radar, monitoring your cash flow in real time. It predicts future cash flows and alerts you to potential shortfalls before they occur. This proactive management is essential, especially for early-stage startups or businesses looking to scale, ensuring that every dollar is optimized for sustained operations and growth.

Securing Investor Confidence

When approaching potential investors, enthusiasm and innovative ideas need to be backed by tangible, compelling financial forecasts. Financial modeling provides a structured way to present expected financial performance, detailed with profit projections, burn rates, and financial health indicators.It’s like offering a detailed preview of your business’s potential returns. This is packaged in accessible, investor-friendly formats such as dynamic financial dashboards and sensitivity analyses.

Driving Strategic Business Planning

Financial modeling isn’t just for immediate planning; it’s a strategic tool that aligns with long-term business strategies. It helps in assessing the viability of proposed projects, the impact of external market conditions, and strategic financial planning. This strategic integration ensures that decisions are not only reactive but are made with a comprehensive understanding of their long-term impacts on the business’s financial targets and objectives.

Simplifying and Visualizing Complex Financial Data

One of the greatest strengths of financial modeling is its ability to break down complex financial data into clear, actionable insights. Through financial models, dense numerical data is transformed into visual graphs, charts, and projections that tell the financial story of your business at a glance. This simplification is crucial for communicating with stakeholders who may not have a background in finance but need to understand the financial trajectory of the busines

Customization and Adaptability

Financial models are highly adaptable, tailored to the specific nuances of your business. They incorporate key performance indicators (KPIs), cash flow projections, balance sheets, and income statements into a unified model that reflects your unique business context. Whether you’re running complex financial scenarios or need straightforward budgeting and financial tracking, modern financial modeling tools and software offer the customization to meet your needs.

In summary, financial modeling is essential for any business that aims to navigate effectively through the financial challenges of today’s market landscape. It equips entrepreneurs and business managers with the tools to make knowledgeable, data-driven decisions that enhance financial performance and stability. Ready to leverage financial modeling to chart a successful course for your business? Let’s get your financial roadmap dialed in and gear up for a journey of growth and profitability.

Frequently Asked Questions

What is a financial model?

It’s a tool that uses spreadsheets to predict a company’s financial performance, integrating various financial statements.

Why are financial models important?

They guide decision-making in finance, helping assess project viability and business valuation.

What are key components of a financial model?

Typical elements include three-statement integration, valuation analysis, and budget forecasts.

Who uses financial models?

Business owners, financial analysts, and investors use them to make informed decisions and evaluate investment opportunities.

How do financial models aid in fundraising?

They provide detailed insights into a company’s financial health and growth potential, crucial for attracting investments.

What are common financial modeling pitfalls?

Complexity and data inaccuracies can skew results, so simplification and careful data review are essential.

Conclusion

Financial modeling is crucial for strategic business planning and decision-making. It empowers companies to forecast financial outcomes, assess company health, and manage resources effectively through tools like financial model templates and software. These models help in predicting future performance, optimizing financial strategies, and communicating with stakeholders, making them indispensable for achieving business goals and securing investments. In summary, financial modeling is vital for any business aiming to thrive in today’s competitive market.

2 Comments