What is Finance?

Finance is all about the management of money and other financial resources. This term includes a vast list of activities that include but are not limited to investing, borrowing, lending, budgeting, saving, and forecasting. Additionally, it guides individuals, companies, and governments in making smart financial decisions. Moreover, it involves various forms of money, from cash to assets, and affects financial transactions and the allocation of capital resources across different markets.

Key Areas of Finance

The three key areas of finance are personal finance, corporate finance and public finance.

Personal Finance

Personal finance means managing individual or household finances. The activities of this type include budgeting, saving, investing, retirement planning, and managing debt. A fine personal finance understanding leads individuals to make informed financial decisions, achieve investment goals, and manage financial advisors’ guidance to optimize resources.

Corporate Finance

It is all about how businesses manage their financial resources. The activities involve raising capital, debt financing, investing in projects, and managing company assets to maximize shareholder value. Key aspects of corporate finance are capital structure, capital budgeting, and working with financial managers to align business finance with corporate strategy.

Public Finance

Public finance deals with government revenue and expenditures. It handles taxation, budgeting, debt management, and the effective use of public funds. This field also examines how financial markets and insurance companies interact with government policies to contribute to the broader financial ecosystem.

Some additional and comparatively new areas of Finance are as follows:

- Behavioral Finance: It is a growing branch of finance that deals with the behavior of people and their financial decisions. It combines psychology and economic theory to understand how emotions and cognitive biases influence financial markets and investment decisions.

- Managerial Finance: Managerial finance is all about the strategic planning and management of a company’s financial operations. This branch focuses on evaluating financial theories and using computational finance models. It also guides the finance community in optimizing long-term finance processes to achieve better outcomes.

- Experimental Finance: Experimental finance examines financial theories through experimental methods. This branch focuses on how real-life market participants react under various market conditions. Additionally, it contributes to understanding market volatility and the impact of behavioral finance studies.

- Climate Finance: Climate finance flows focus on funding initiatives that support climate action, adaptation actions, and sustainable projects. This includes financial support for projects aimed at reducing greenhouse gas emissions. It also focuses on enhancing climate resilience and promoting sustainable development across various regions.

Financial Markets and Transactions

Finance covers a wide range of financial transactions in financial markets, such as the bond market, the stock market, and investment banks. These markets ease the trading of assets and the movement of capital from angel investors, private capital sources, and other forms of investment. Key players in these markets are insurance companies, investment banks, and other financial institutions. These players help manage the flow of capital and provide coverage for market volatility.

History and Evolution of Finance

The history of finance dates back to the earliest forms of money and trade. It has evolved through centuries to include complex financial markets and sophisticated financial theories. Today, It confines a diverse range of studies. We are witnessing the emergence of experimental finance, behavioral finance, and computational finance. In short, all these emerging fields and branches of finance reflect its dynamic and ever-evolving nature.

How Can OfficeDocDepot Enhance Your Financial Toolkit?

At OfficeDocDepot, we recognize the vital role that the right tools and skills play in the finance sector. Finance professionals often rely on a unique combination of personal expertise and specialized tools to manage both their daily tasks and extraordinary challenges effectively. These tools can range from bespoke solutions crafted from years of industry experience to ready-to-use resources developed by peers or provided by the firm.

OfficeDocDepot acts as a vital bridge between the creators of financial tools and the users who benefit from them. Our platform is dedicated to facilitating the sharing of knowledge and resources, allowing finance professionals to build upon existing work rather than starting from scratch. This approach helps save time and fosters innovation within the community.

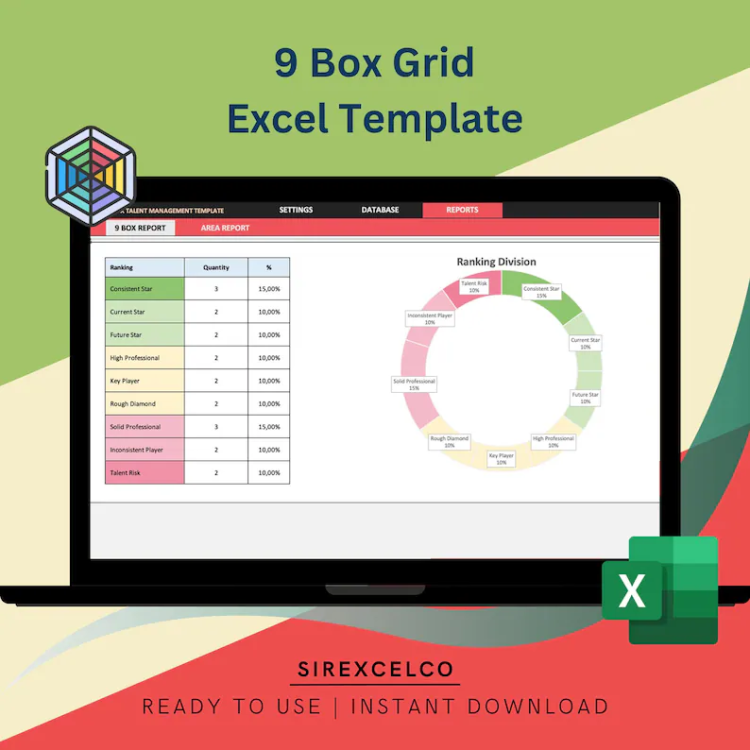

On our site, you can download a variety of Excel financial models and methodologies crafted by world-class academics, experts, and professionals. We also encourage open discussions to further refine these tools.

Explore OfficeDocDepot today and see how you can enhance your financial toolkit by leveraging the collective wisdom of finance experts around the globe.

Frequently Asked Questions

What is the difference between Finance and Accounting?

Finance manages money, investments, and strategic planning for future growth. Accounting, on the other hand, records and reports financial transactions, focusing on compliance and past performance. Finance looks ahead, while accounting looks at what has already happened.

What challenges do financial markets face with coverage of market volatility?

Financial markets face challenges in providing consistent coverage of market volatility, as the characteristics of market participants and trading flows can lead to unpredictable changes in asset values.

How do collective investment schemes work?

Collective investment schemes pool funds from multiple investors to invest in a diversified portfolio of assets, stock, common stock, or bonds managed by professional investors.

What is the significance of classical theories in finance?

Classical theories in finance, such as the capital asset pricing model, provide foundational insights that guide investment strategies, risk assessment, and the behavior of decision-makers in financial markets.

Conclusion

Finance is a vast field that impacts every aspect of economic life. From the personal finance decisions of the average person to the strategic maneuvers of corporate and public finance sectors, finance affects each sector. Understanding finance and its transactions helps individuals and organizations navigate complex financial markets. This knowledge is key to achieving financial goals.

-

(Renewable Natural Gas Producers) Biomethane Financial Model

The Biomethane Production Business 10-Year Financial Forecast Model is a comprehensive tool designed for renewable energy ventures. It covers up to 10 years of financial forecasting, integrating income statements, balance sheets, and cash flow statements. The model supports detailed site deployment costs, feedstock and gas yield analysis, operating expenses, CapEx, debt financing, and equity contributions. It includes advanced features like discounted cash flow (DCF) analysis, IRR calculations, and visual dashboards to track production, revenue, and scalability. Ideal for project evaluation, investor presentations, and strategic planning.

$ 45 -

2025 INFLATION CALCULATOR

Excel Inflation Calculator covering 50 countries. FULLY EDITABLE. Usable on its own or incorporated into your financial planning tool.

$ 0$ 202025 INFLATION CALCULATOR

$ 0$ 20 -

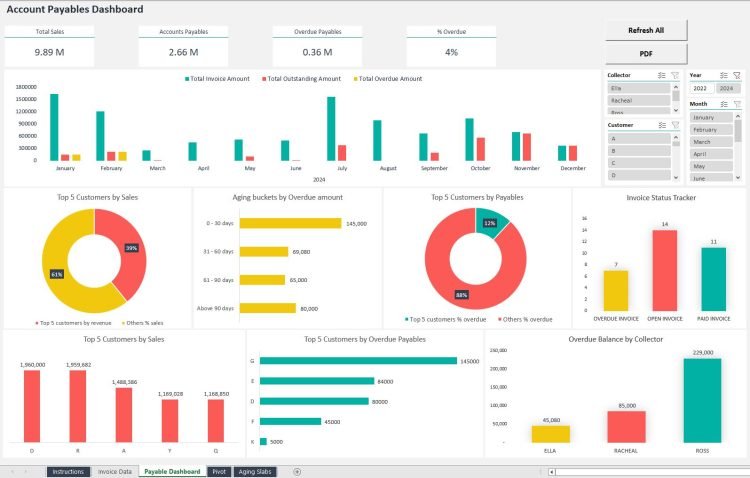

Accounts Payable Template / Invoice Tracking – Aging Report – Supplier Statement

Accounts Payable template including Aging Reports and Account Statements, designed to help businesses organize and track suppliers invoices and payments.

$ 69 -

Accounts Receivable Excel Template

Accounts Receivable Dashboard: Tracking Key Metrics and Payments Effectiveness.

$ 19 -

Accounts Receivable Template / Invoice Tracking – Aging Report – Customer Statement

Accounts Receivable template including Aging Reports and Account Statements, designed to help businesses organize and track customer invoices and payments.

$ 69 -

Acupuncture Center Excel Financial Model Template

The Financial Analysts at Oak Business Consultant have created this complete and dynamic Acupuncture Center Excel Financial Model Template for your financial planning needs. The model has a 5-year financial projection plan to track steady growth and profitability. It can also estimate ongoing operating expenses, monthly sales revenue, startup investment requirements, and inventory. With this easy-to-use template, there is no further need for complex calculation, you need to add numbers, and you are all set.

$ 195$ 350 -

Advance Accounts Payable Excel Template

Enhance Accounts Payable Management with Excel Spreadsheet Template.

$ 49 -

Advance Accounts Receivable Excel Template

Enhance Accounts Receivable Management with Excel Spreadsheet Template

$ 49 -

Advanced Financial Model with DCF and Valuation

Dynamic 10-Year Financial Model, suitable for any type of business, supporting strategic planning, investment decisions, and business valuation.

$ 139