Banking Dynamic & Granular Finanical Model 2026 (All Bank Types)

$ 249$ 299 (-17%)

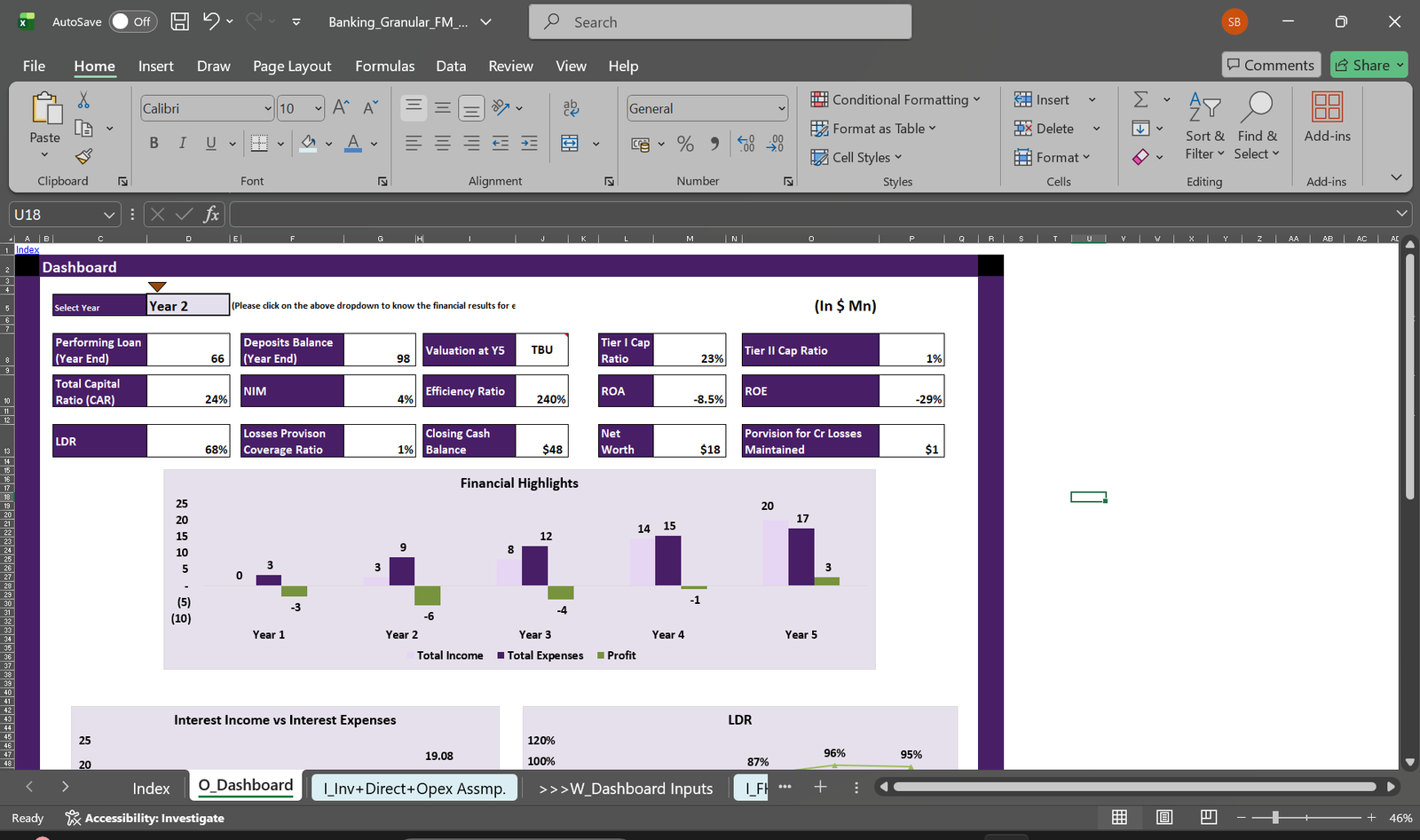

A fully dynamic, granular banking 5 Years Quarterly financial model designed to work across universal, commercial, community and Other banks. It captures detailed interest and non-interest revenue streams, integrates Tier 1 & Tier 2 capital ratios, Profitability Ratios, and enables scalable forecasting, scenario analysis, and regulatory-ready insights—all in one flexible framework.

Banking Finanical Model Overview

Note: You can request a Custom Revision of model as well and we will do the needful.

Highlights:

-

Fully dynamic 5-year banking financial model where users only need to update blue-highlighted input cells to automatically refresh the entire model.

-

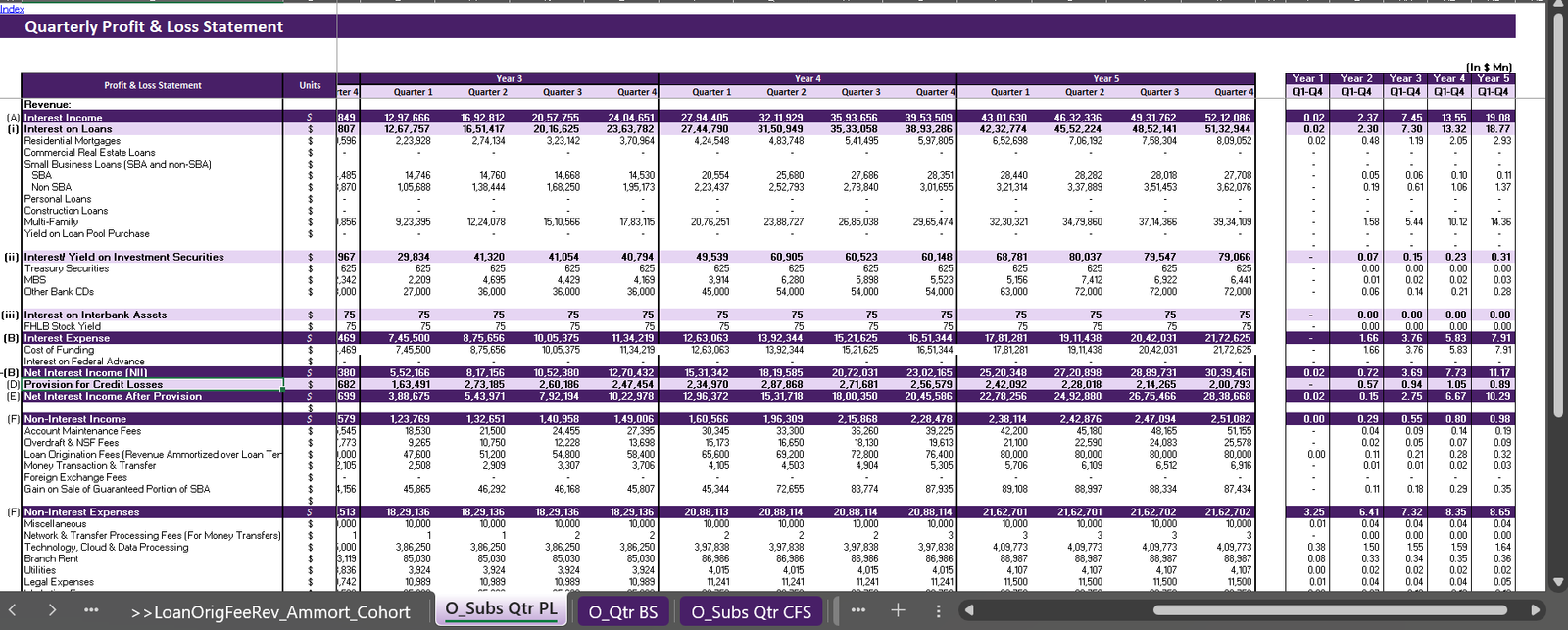

Granular revenue framework covering both interest income and non-interest income across multiple banking products and services.

-

Capital ratios module including Tier 1 and Tier 2 ratios, integrated with growth and balance sheet movements.

-

Built-in summary dashboard providing a clear, high-level view of key financials, trends, and performance indicators.

Sheets:

- Index

- Dashboard – Contatining Overall Summary

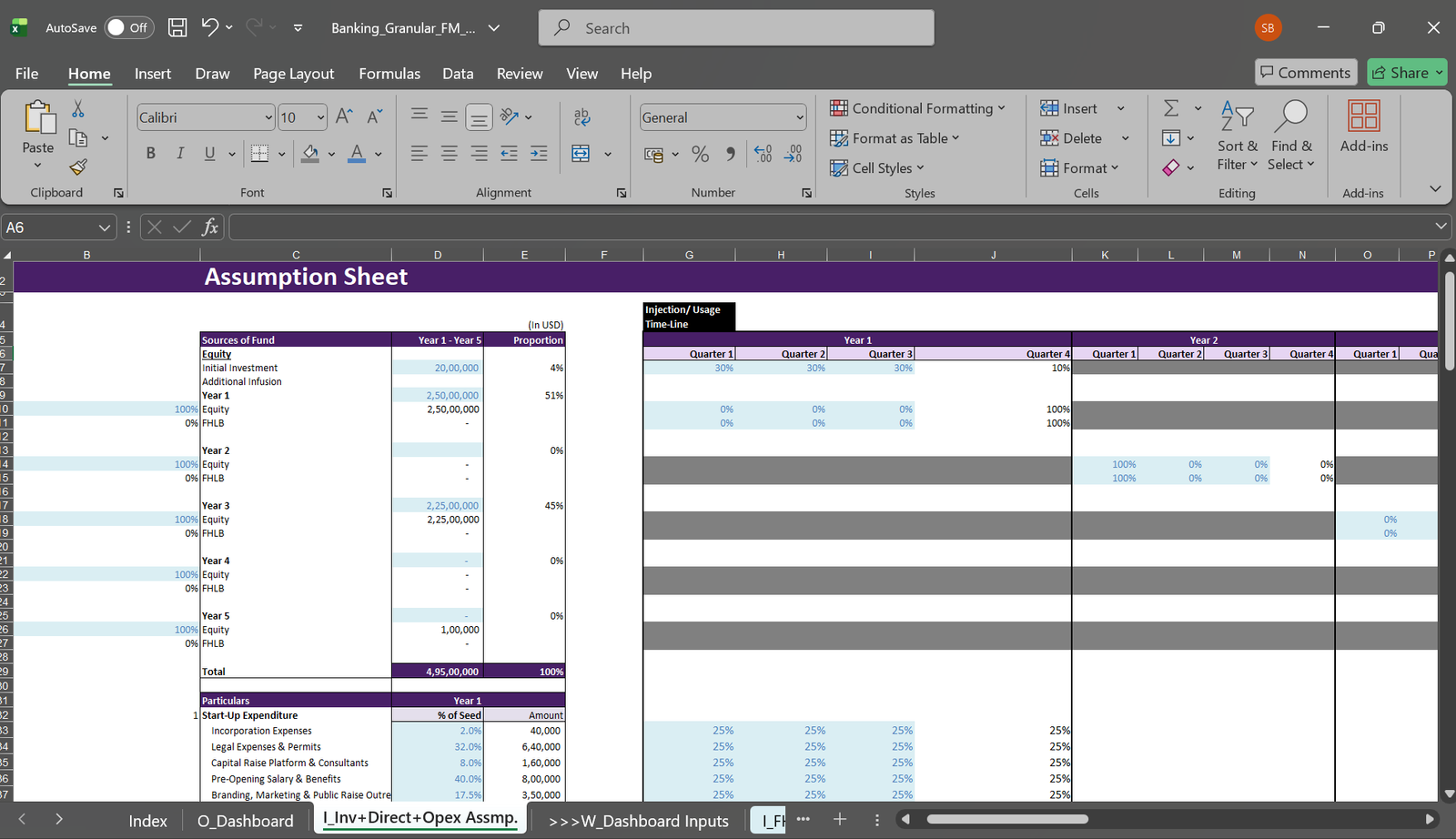

- I_Inv+Direct+Opex Assumptions – If Required user can update FHLB advance Requirment Here, Also inlcudes Start-up expenditure, Assets, Technological Infra, and Contigency & Cash Buffer Reqruiemnt out of total investment. General Assm like Inflation, Salary Increment, expesnes asump for Direct and Opex, Types of Staff Required.

- I_FHLB Advance + Stock – If FHLB amt entrered in previous sheet this sheet will auto update.

- I_Revenue Model_LoanToCustomers – Residential Mortgages

Commercial Real Estate Loans

Small Business Loans (SBA and non-SBA)

SBA

Non SBA

Personal Loans

Construction Loans

Multi-Family - I_Deposits – User Deposits , this will influence cost of funding.

- I_Investment_Income – T-Bill, MBS, Etc

- Non-Interest Income – Account Maintenance Fees, Overdraft & NSF Fees, Loan Origination Fees, Money Transaction & Tr., Inter Bank Tr., Intra Bank Transfer, etc.

- O+I_Qtr Ratios – Profitability Ratios + Capital Ratios

- O_Qtr CFS – Cash Flow Statement

- O_Qtr PL – Profit & Loss Account as per US GAAP.

- O_Qtr BS – Balance Sheet with annual view

- I+O_Valuation – On-Demand

- Loan Ammortization Sheets

Shipping Policy

Refund Policy

General Inquiries

There are no inquiries yet.

Reviews

There are no reviews yet.