Lending Financial Model with Upfront Equity

$ 75

This comprehensive Excel model forecasts the financial performance of a lending business over 10 years. It includes detailed loan configuration for interest-only and principal-and-interest loans, tracks loan disbursements and repayments, calculates origination fees and interest revenue, and generates robust financial statements, including balance sheets.

The Lending Business 10-Year Financial Model is a sophisticated Excel tool designed to provide a comprehensive financial forecast for lending businesses or individuals participating in peer-to-peer lending. This model allows users to simulate various lending scenarios, track loan performance, and analyze the financial impact of different lending strategies.

Key Features:

Flexible Loan Configuration:

- Models three loan types: interest-only loans, interest-only followed by principal-and-interest (P&I) loans, and P&I loans.

- Allows users to define loan origination schedules, loan counts, average loan amounts, interest rates, and loan terms.

- Calculates interest revenue, principal repayments, and origination fees for each loan type.

Detailed Loan Tracking:

- Tracks loan disbursements, principal collections, and outstanding loan balances on a monthly basis.

- Accounts for loan defaults with a customizable default rate.

Comprehensive Financial Statements:

- Generates monthly and annual income statements, balance sheets, and cash flow statements.

- Provides detailed tracking of revenue, expenses, and cash flow, including loan disbursements, repayments, and interest revenue.

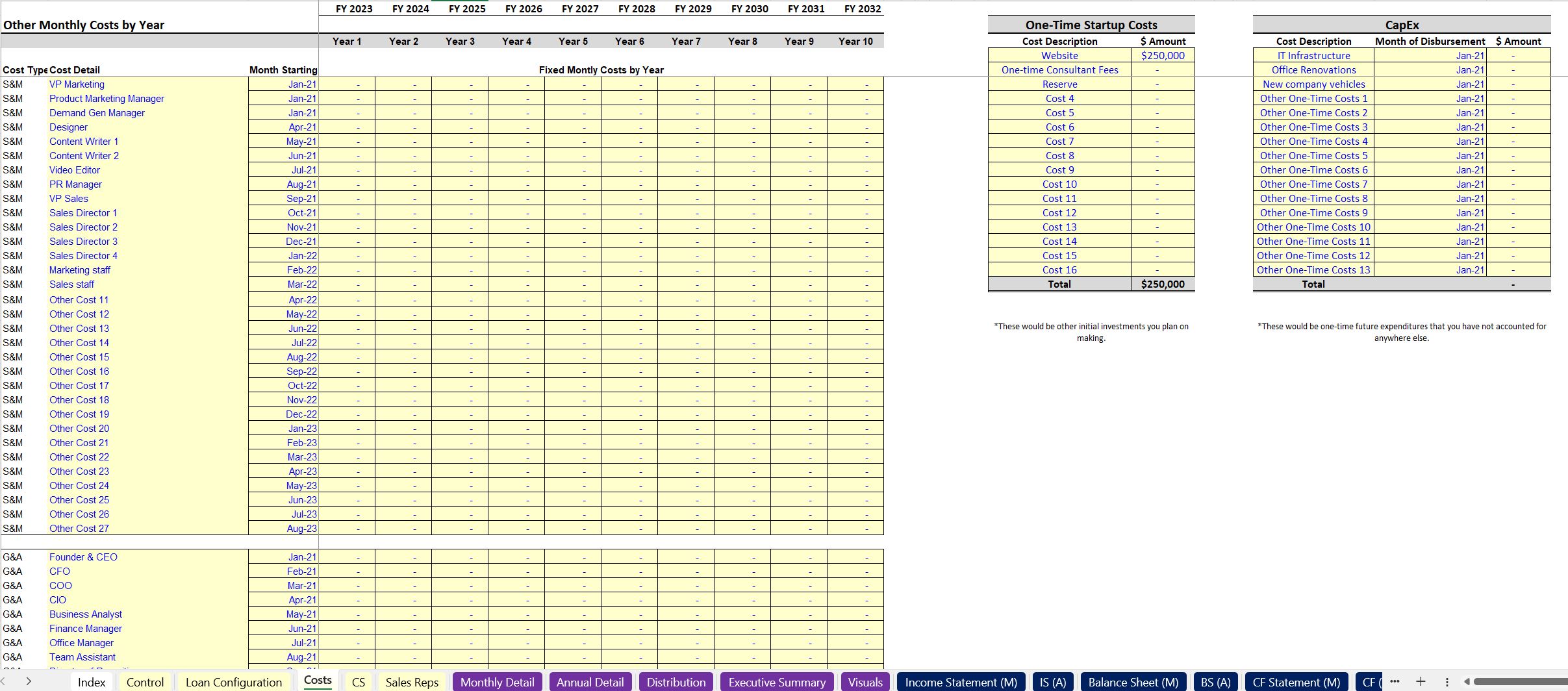

Expense Modeling:

- Models operating expenses, cost of goods sold, startup costs, and capital expenditures.

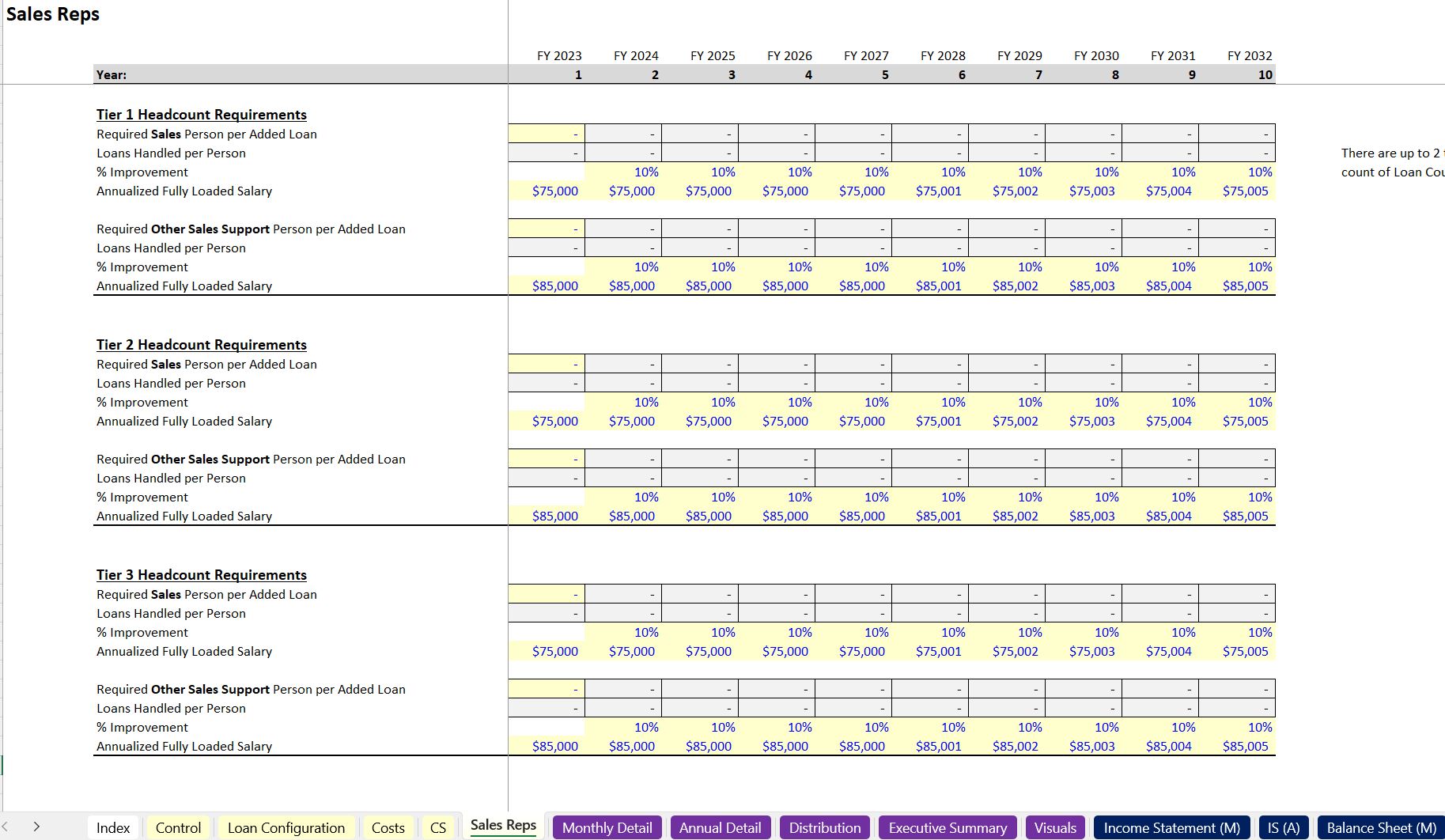

- Includes sections for modeling customer service and sales representative salaries and headcount.

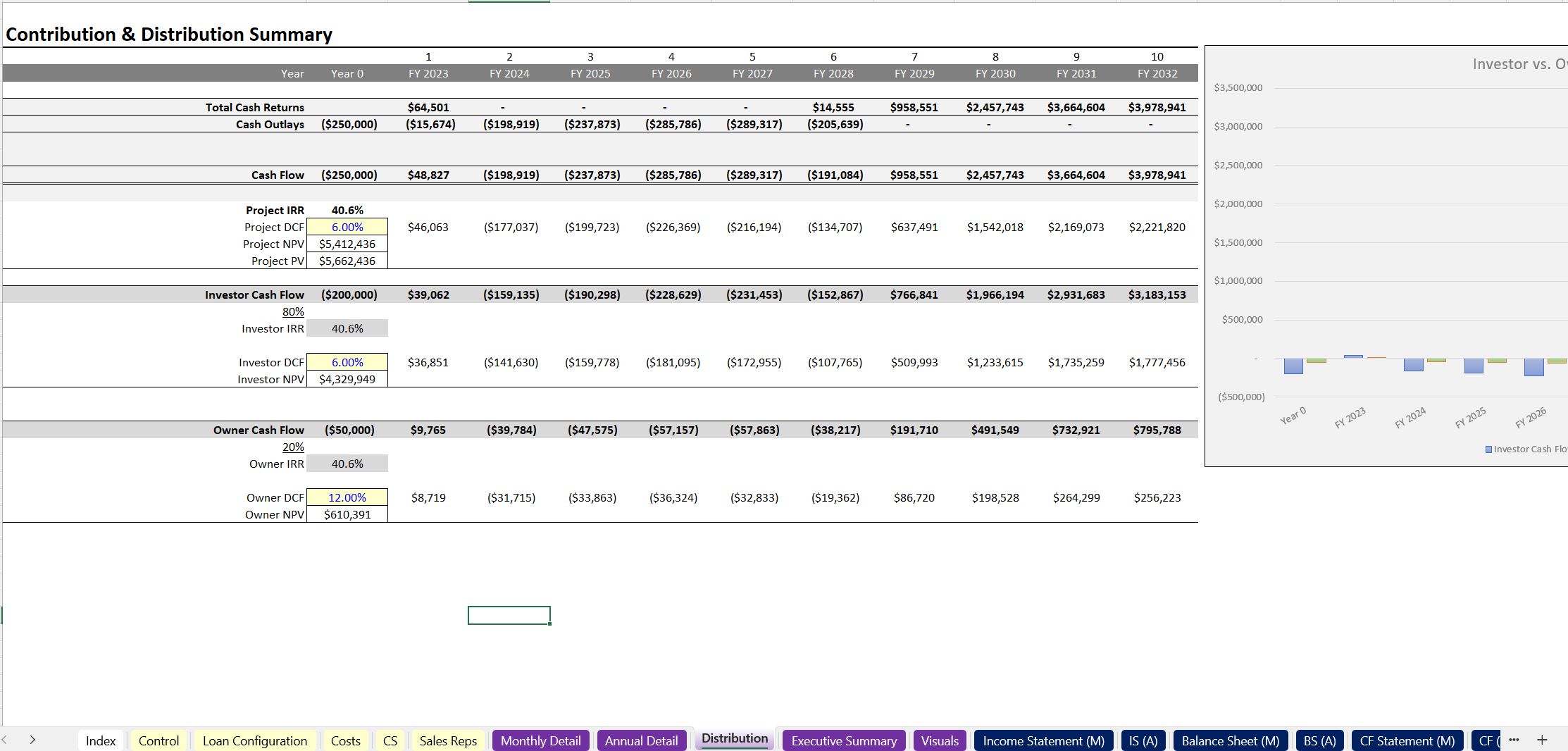

Equity and Debt Financing:

- Allows users to model equity contributions from investors and owners, as well as debt financing.

- Calculates equity requirements based on startup costs and negative cash flows.

- Creates a debt amortization schedule.

Terminal Value Calculation:

Calculates the terminal value of the business based on the net asset value of loans receivable, less debt and seller fees.

Cash Distribution Logic:

- Allows users to choose whether to distribute excess cash or retain it in the business.

- Automatically calculates distributions based on available cash flow.

Robust Visualizations:

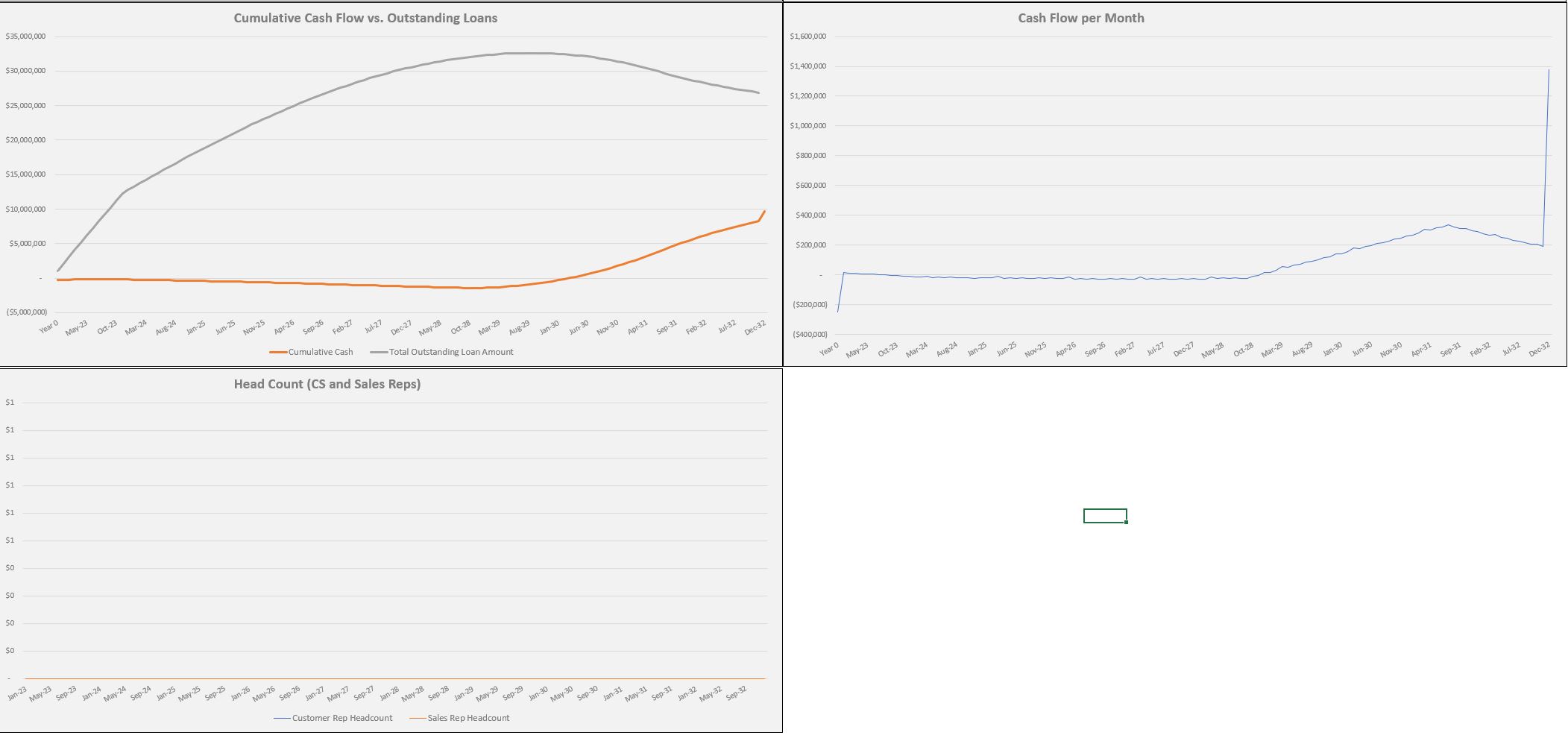

Provides charts and graphs illustrating key financial metrics, including loan performance, revenue, cash flow, and headcount.

Detailed Monthly Logic:

The model uses very complex logic to calculate all loan activity, and produce accurate financial statements.

Functionality:

- Users input data related to loan configurations, expenses, and financing.

- The model automatically calculates loan performance, generates financial statements, and creates visualizations.

- Users can analyze the impact of different lending strategies and assumptions on the financial performance of the business.

Benefits:

- Provides a robust and flexible tool for analyzing lending business financial performance.

- Enables users to evaluate various lending scenarios and strategies.

- Facilitates informed decision-making through comprehensive financial reporting and analysis.

- Helps to accurately project cash flow needs and investor returns.

This model is an invaluable resource for lending business owners, investors, and financial professionals seeking to analyze and optimize the financial performance of lending operations.

Refund Policy

There are no refunds, all sales are final.

Cancellation / Return / Exchange Policy

For intellectual property, there are no returns / exchanges. All the files are downloadable, editable, and unlocked.

General Inquiries

There are no inquiries yet.

Reviews

There are no reviews yet.