Oil and Gas Wells Financial Model

$ 70

This Excel-based 20-year financial model allows users to forecast oil and gas well production, costs, and returns. It includes features for modeling multiple well cohorts, exploration, drilling, extraction costs, revenue projections, and a dynamic joint venture waterfall analysis.

The Oil and Gas Wells 20-Year Financial Model is a sophisticated Excel tool designed to provide a comprehensive financial forecast for oil and gas exploration and production projects. This model enables users to meticulously plan and analyze various aspects of their operations, from initial exploration to long-term profitability. The model is organized into distinct tabs, each serving a critical function:

Global Control:

- Sets foundational parameters, including company name, launch year, forecast end month, and provides resources for oil and gas research.

- It also summarizes total activity for GP and LP contributions and distributions.

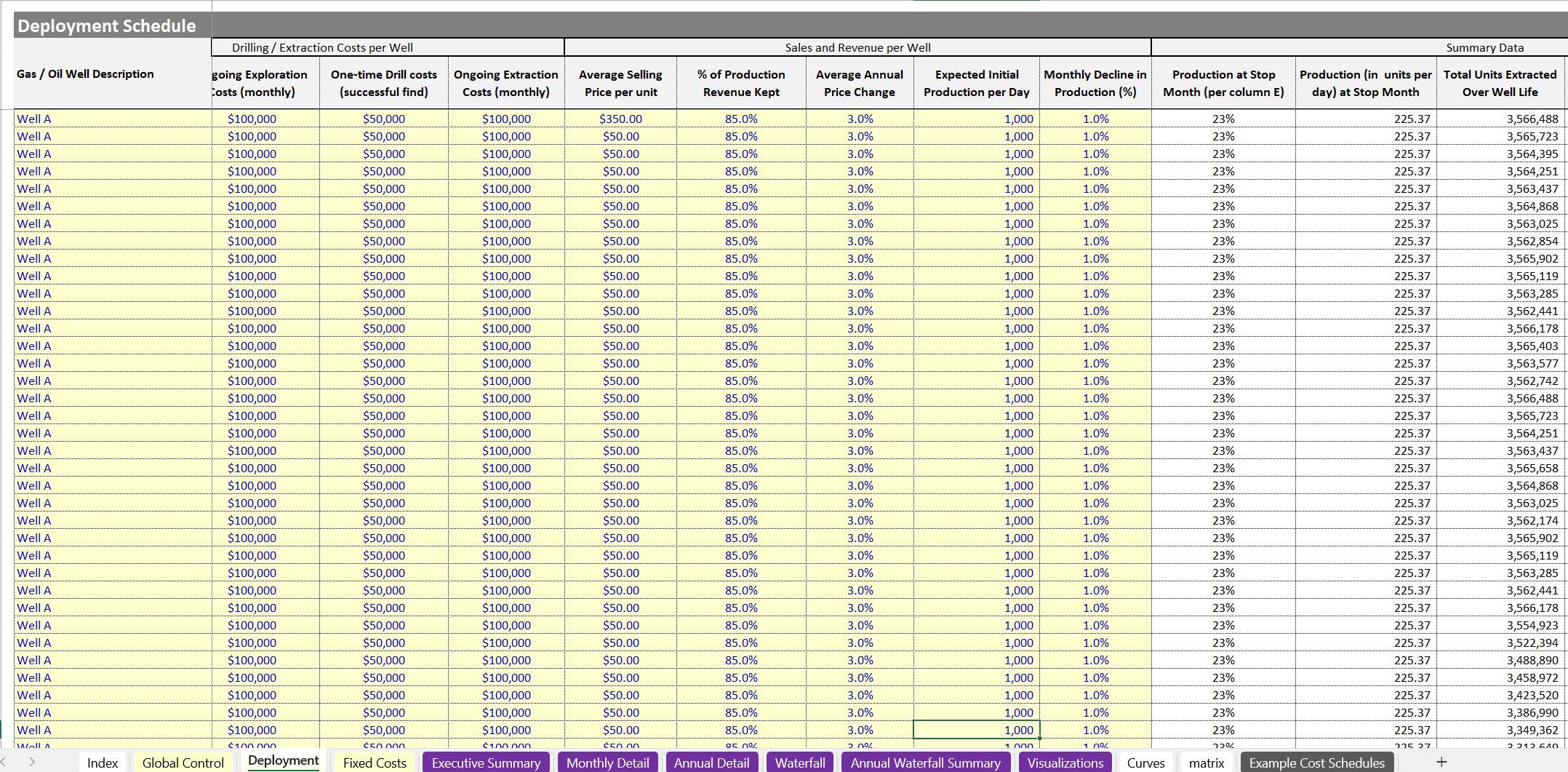

Deployment:

- Defines well cohorts, drilling schedules, exploration periods, success rates, drilling costs, extraction costs, revenue assumptions (selling prices, royalties), and production decline rates.

Fixed Costs:

- Models ongoing operational expenses, including executive team costs and other fixed costs.

- Other Costs: Defines catch-all costs as a percentage of net revenue.

Executive Summary:

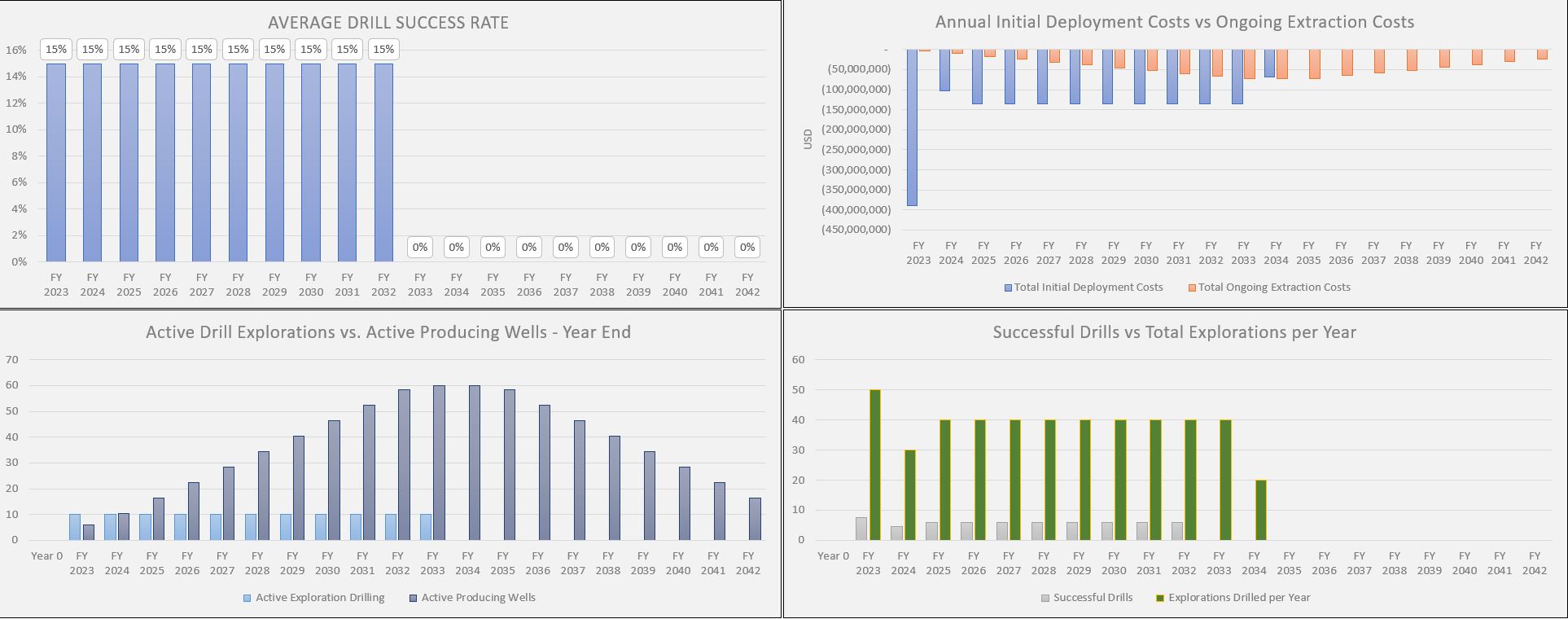

- Presents a high-level overview of the project’s financial performance, including well drilling activity, revenue, costs, cash flow, and visualizations.

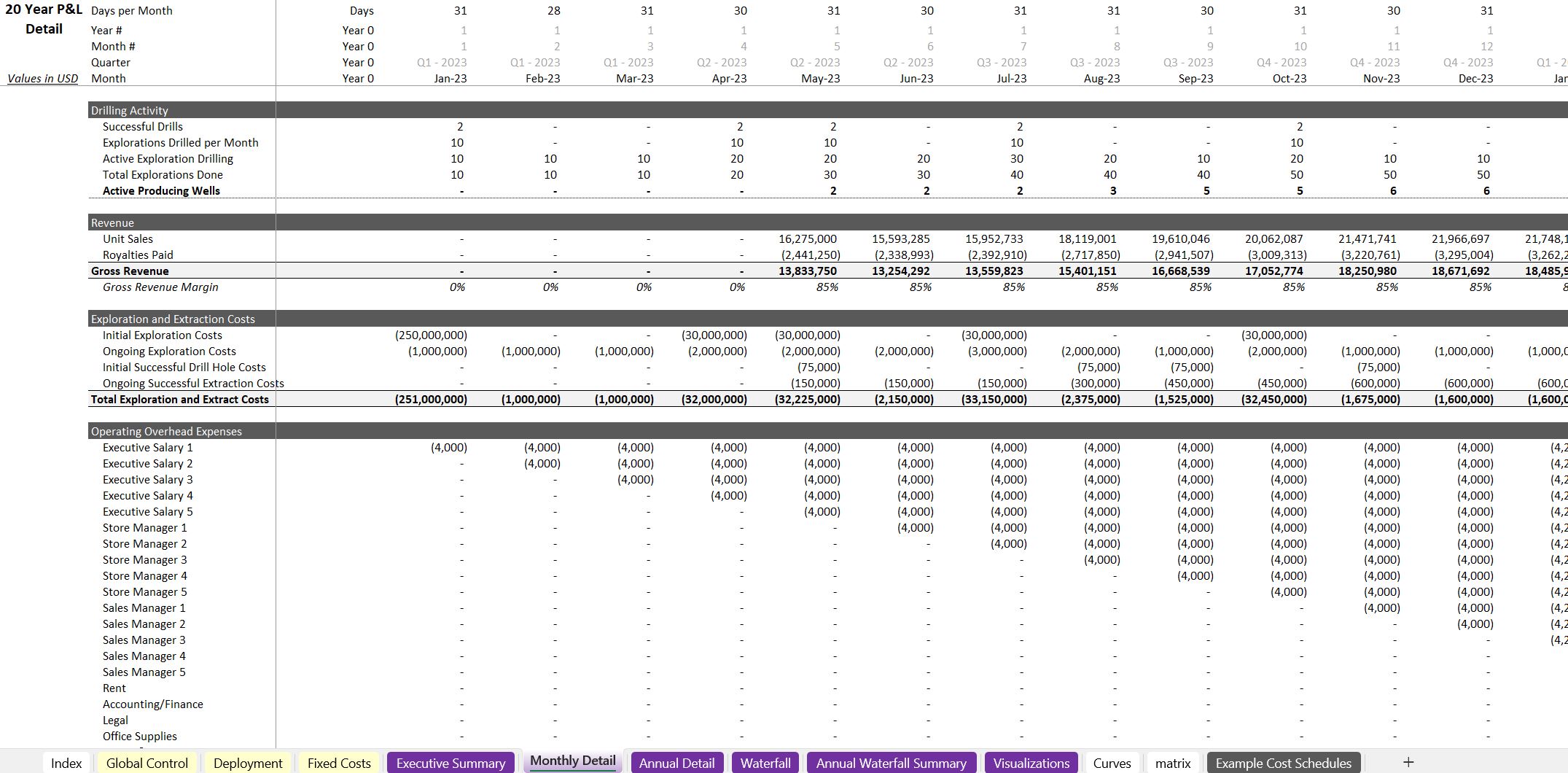

Monthly Detail:

- Provides detailed monthly projections, including drilling activity, revenue, costs, taxes, and cash flow.

Annual Detail:

- Aggregates monthly data into annual projections, providing a comprehensive view of the project’s financial performance over 20 years.

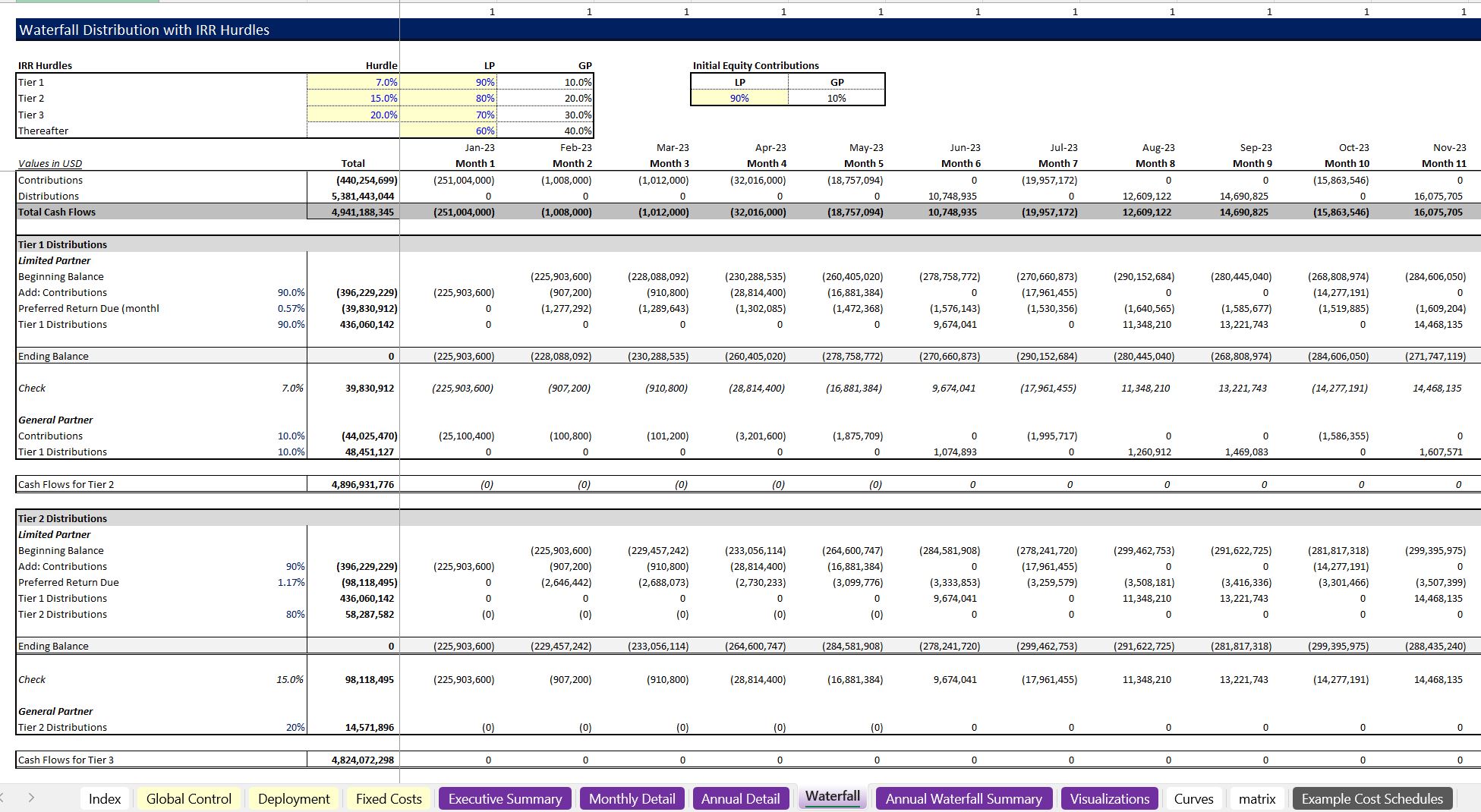

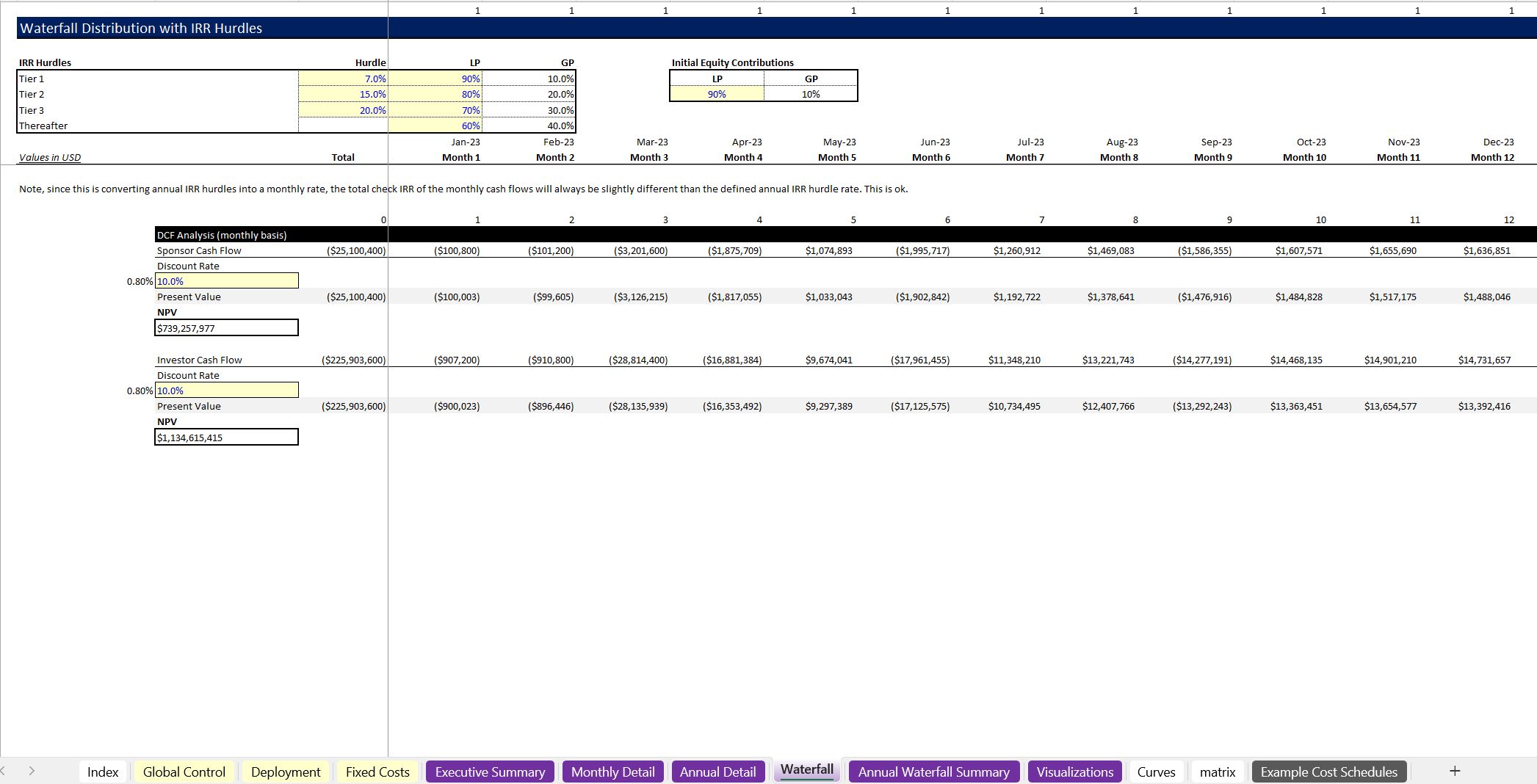

Waterfall:

- Models joint venture structures, including GP/LP splits, preferred returns, hurdle rates, and cash flow distributions.

Visualizations:

- Offers a suite of charts and graphs visualizing key performance indicators, including units sold, revenue, cash flow, drilling activity, and production decline curves.

Matrix:

- Houses the dynamic logic for calculating production, revenue, and costs based on deployment assumptions.

Example Cost:

- Provides a space for users to input detailed cost breakdowns for reference.

Key Features of Oil and Gas Wells Financial Model:

- Detailed modeling of multiple well cohorts with customizable drilling schedules and success rates.

- Comprehensive cost modeling, including exploration, drilling, extraction, and fixed costs.

- Dynamic revenue projections based on selling prices, royalties, and production decline rates.

- Automated cash flow calculations and internal rate of return (IRR) analysis.

- Robust joint venture waterfall modeling with customizable hurdle rates and GP/LP splits.

- Extensive visualizations to track key performance indicators and project performance.

- Ability to model exponential decline curves of production.

- Ability to model costs as a percentage of revenue.

This model is an invaluable tool for oil and gas companies, investors, and financial professionals seeking to evaluate the financial viability of exploration and production projects.

Refund Policy

There are no refunds, all sales are final.

Cancellation / Return / Exchange Policy

For intellectual property, there are no returns / exchanges. All the files are downloadable, editable, and unlocked.

General Inquiries

There are no inquiries yet.

Reviews

There are no reviews yet.