Solar Farm Financial Model

$ 60

This Solar Farm 20-Year Financial Forecasting Model is a comprehensive tool for projecting the financial performance of a solar farm over two decades. It includes detailed inputs for deployment costs, energy output, seasonality, revenue streams, operating expenses, and financing. Customizable assumptions allow for testing different scenarios with in-depth financial statements, cash flow analysis, and investor returns. This model is ideal for solar developers and investors seeking to evaluate the financial viability of solar farm projects.

The Solar Farm 20-Year Financial Forecasting Model is an advanced and highly customizable tool designed to provide a detailed and accurate financial outlook for solar farm projects.

- This model is ideal for developers or investors looking to evaluate a solar farm project in-depth, taking into account both expected revenues and costs throughout the life of the farm, including seasonal variations in energy production, fluctuating electricity prices, and long-term capital and operating expenditures.

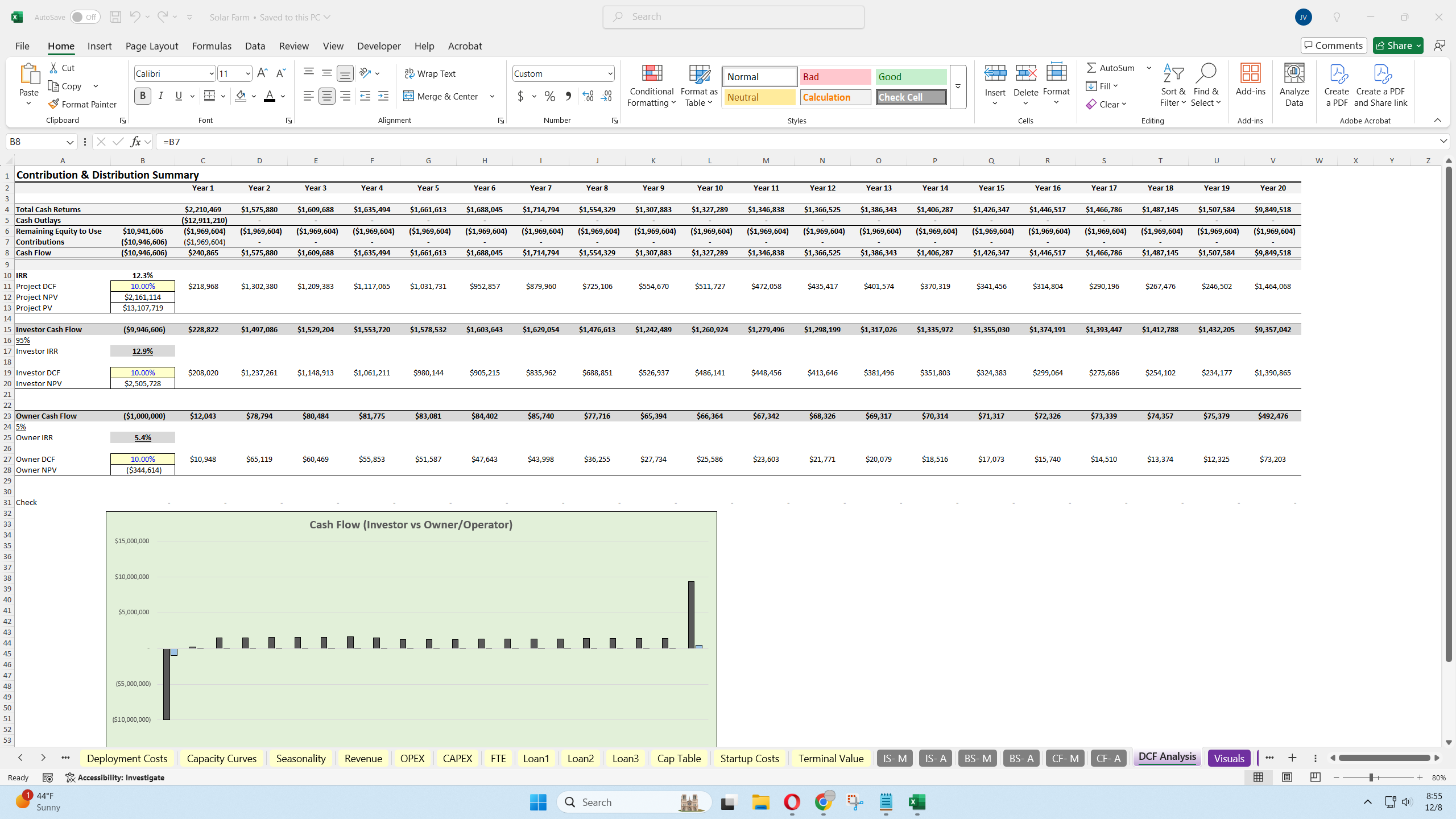

- It integrates key metrics like cash flow analysis, internal rate of return (IRR), and net present value (NPV) to provide a comprehensive financial overview.

Key Features and Sections of Solar Farm Financial Model:

Company Setup & Forecast Period

- Company Name: The first step involves defining the company name, which will appear on all financial statements.

- Forecast Period: Users can customize the forecast length (up to 20 years), with different timeframes available, such as 120 months (10 years), 60 months (5 years), etc.

- Terminal Value: Optionally include a terminal value at the end of the forecast period, calculated based on a multiple of trailing 12-month EBITDA. This feature is important for estimating the project’s long-term residual value and assessing its potential sale or ongoing income post-forecast.

Deployment Costs

This section details the initial capital expenditures required to set up the solar farm. Key inputs include:

- Farm Size: The total capacity of the farm in megawatts (MW) and the number of solar panels required based on the capacity per panel.

- Cost Per Panel: Input the purchase price of each panel, which affects the total deployment costs.

- Mounting & Inverter Costs: Include installation costs per panel and the associated inverter costs, with the ability to define the number of panels per inverter.

- Electrical & Wiring Costs: Set the cost per kilowatt of capacity for wiring and electrical setup.

- Land Costs: Account for the land required to install the panels (in acres per megawatt) and costs per acre. If leasing land, this section can be adjusted to zero out land acquisition costs, with leasing costs managed in the operating expenses section.

- Labor Costs: Define labor costs per kilowatt during installation. This includes both direct labor and any additional construction-related expenses.

- Total Deployment Cost: All the above costs are summed up, factoring in additional capital expenditures (capex) like permitting and compliance costs. There is also an option to add a contingency percentage to account for unexpected cost increases, which is especially useful for large-scale projects with complex requirements.

Energy Output & Efficiency

Understanding the farm’s energy production is critical. This section allows users to input and adjust the following:

- Effective Solar Hours: The number of hours the solar farm receives sunlight annually, which varies based on geographic location.

- Efficiency Losses: The model accounts for a range of efficiency losses, such as:

- Panel Temperature Loss: Energy loss due to temperature fluctuations.

- Inverter Efficiency: Loss in energy during conversion from DC to AC.

- Wiring Loss: Energy loss in the electrical system.

- Soiling Loss: Loss caused by dirt accumulation on panels.

- Degradation Over Time: A gradual reduction in panel efficiency over the years.

- Downtime: The model also considers periods when the farm is offline for maintenance or other reasons, further impacting energy output.

These inputs allow for the calculation of the realistic megawatt hours (MWh) generated annually, factoring in inefficiencies and downtime.

Seasonality

Solar farms experience seasonal fluctuations in energy production due to varying sunlight across different months.

- This section allows users to input a monthly percentage of annual capacity based on the farm’s geographical location and seasonal sunlight patterns, ensuring that monthly revenue projections are as accurate as possible.

Revenue Streams

The model incorporates multiple revenue streams from the solar farm’s operations:

- Power Purchase Agreements (PPAs): These are long-term agreements where energy is sold to customers at a fixed rate. The user can define the rate per megawatt-hour (MWh), the starting percentage of annual capacity sold through PPAs, and annual rate increases.

- Renewable Energy Credits (RECs): These credits are generated for each MWh of renewable energy produced. The model allows users to define the sale price of RECs, which provides an additional revenue stream for solar farm operations.

- Grid Sales: Any excess energy produced can be sold to the grid at variable rates. Users can define the rates for grid sales, and the model will calculate this additional income based on production and sales volume.

Each of these revenue streams is customizable, with the ability to set different pricing schedules and annual rate increases.

Operating Expenses (Opex)

Operating expenses are essential for understanding the ongoing costs associated with maintaining and running the solar farm. The model allows users to input both fixed and variable costs:

- Fixed Costs: These are recurring expenses, such as insurance premiums, land leases, and service contracts. Some costs are automatically adjusted annually, while others can be customized.

- Variable Costs: These expenses vary depending on energy production, such as maintenance costs, grid fees, and REC tracking fees. The model allows for these costs to be input per megawatt hour generated, ensuring that they scale with energy output.

Capital Expenditures (Capex) & Depreciation

- Capex Overview: This section provides a detailed list of capital expenditures drawn from the deployment costs, including installation, equipment, and other essential investments.

- Depreciation: Users can input the useful life of each asset to calculate monthly depreciation. Depreciation affects gross profit but is added back into EBITDA calculations as a non-cash expense.

Staffing & Loans

- Staffing: The model allows for the definition of full-time employees, their salaries, and benefits, which contribute to operational expenses.

- Loans: You can include construction loans with interest-only periods, followed by amortization. The model also allows for additional working capital loans if required. All loan terms, interest rates, and repayment schedules are customizable, providing flexibility in financing.

Cap Table & Financing

- The model calculates the minimum equity required to maintain a positive cash balance throughout the project lifecycle.

- Users can allocate equity contributions between inside and outside investors and adjust profit-sharing percentages.

- This feature is especially useful for structuring different funding scenarios and understanding the capital requirements for the project.

Financial Statements and Analysis

The model provides a comprehensive set of financial statements, including:

- Income Statement: Breaks down revenues, costs, gross profit, operating expenses, and net income, providing a detailed look at profitability.

- Balance Sheet: Tracks assets, liabilities, and equity, ensuring everything balances in the financial structure.

- Cash Flow Statement: Shows cash inflows and outflows, including capital expenditures, loan repayments, and operational revenues. It helps identify when the solar farm becomes cash-flow positive.

The model also includes a Discounted Cash Flow (DCF) Analysis to calculate Net Present Value (NPV) and Internal Rate of Return (IRR) for both the project and its investors, helping stakeholders assess the project’s financial viability and investment return potential.

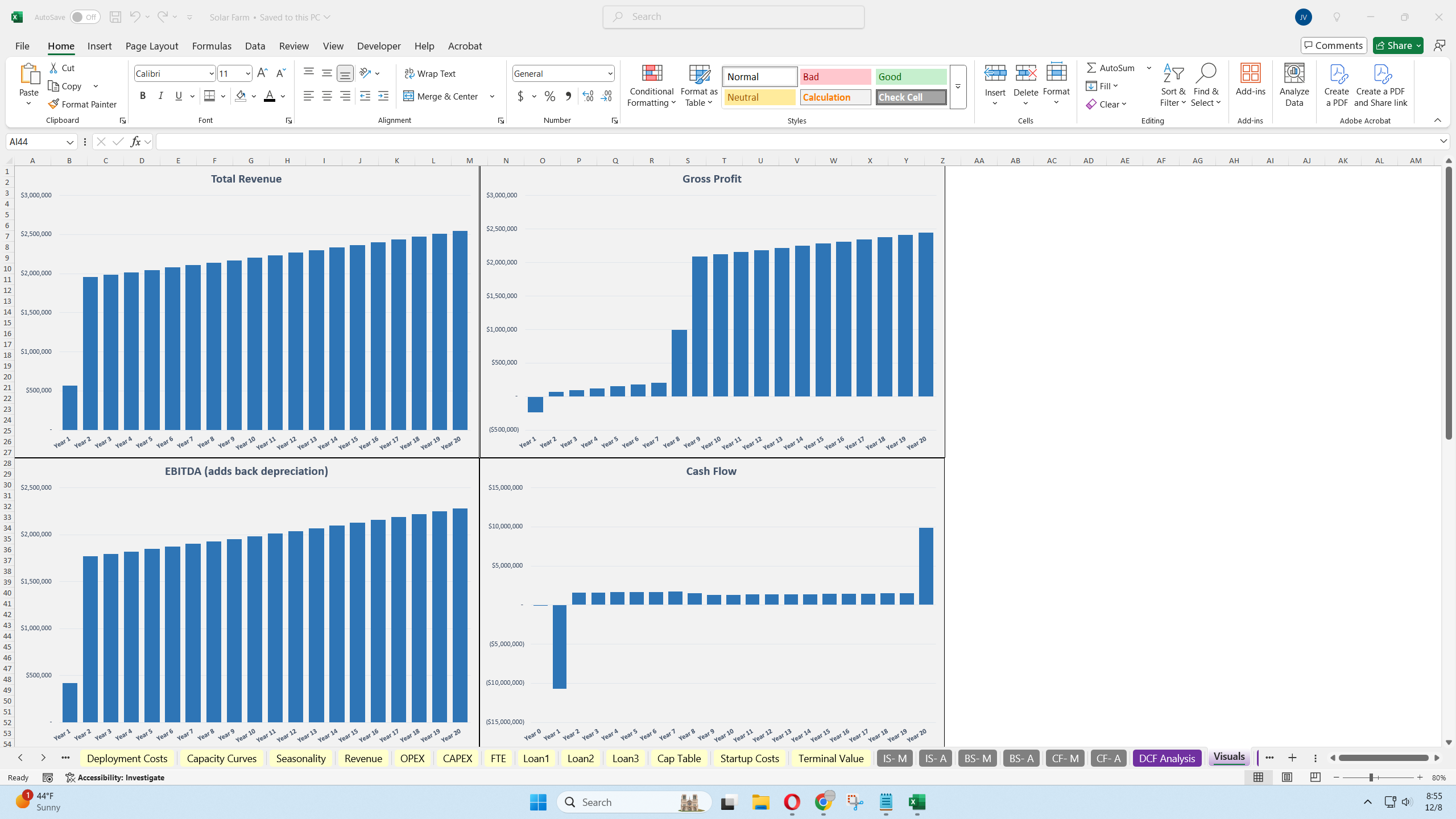

Visualizations & Reporting

The model features comprehensive visualizations, including:

- Revenue Breakdown by Type: Visualize income from PPAs, RECs, and grid sales.

- Efficiency Factors: Display how various inefficiencies impact energy output and revenue generation.

- Annual & Cumulative Cash Flow: Track cash inflows and outflows over the project’s lifespan.

- Cumulative Installations & Energy Output: Monitor solar farm performance and growth.

Charts and graphs provide valuable insights into key metrics, helping investors, developers, and consultants make data-driven decisions.

Refund Policy

There are no refunds, all sales are final.

Cancellation / Return / Exchange Policy

For intellectual property, there are no returns / exchanges. All the files are downloadable, editable, and unlocked.

General Inquiries

There are no inquiries yet.

Reviews

There are no reviews yet.