Insurance Company – 10-Year Financial Model: A comprehensive and customizable financial model for insurance businesses, covering policy revenue, claims, expenses, cash flow, valuation, and investor returns.

Insurance Company – 10 Year Financial Model

$ 119

10-Year Insurance Company Financial Model built to support premium forecasting, claims analysis, and long-term financial planning. The model covers core revenue streams such as underwriting income and investment returns, while detailing claims payouts, reinsurance costs, operating expenses, and regulatory capital requirements. Whether launching a new insurer or managing an established operation, this model delivers the financial structure and clarity needed for sound decision-making and sustainable growth.

Insurance Company – 10 Year Financial Model Description

An Insurance Company provides financial protection to individuals and businesses by covering risks in exchange for premium payments. It pools risk across policyholders and pays out claims for covered events like accidents, health issues, property damage, or loss of life. Insurance companies generate revenue through premiums and investment income, while managing risk through underwriting and actuarial analysis.

User-friendly Financial Model presenting a business scenario of an Insurance Company. Suitable for either a startup or existing company, the model is a flexible tool for business owners to control and improve daily operations and forecast the company’s growth.

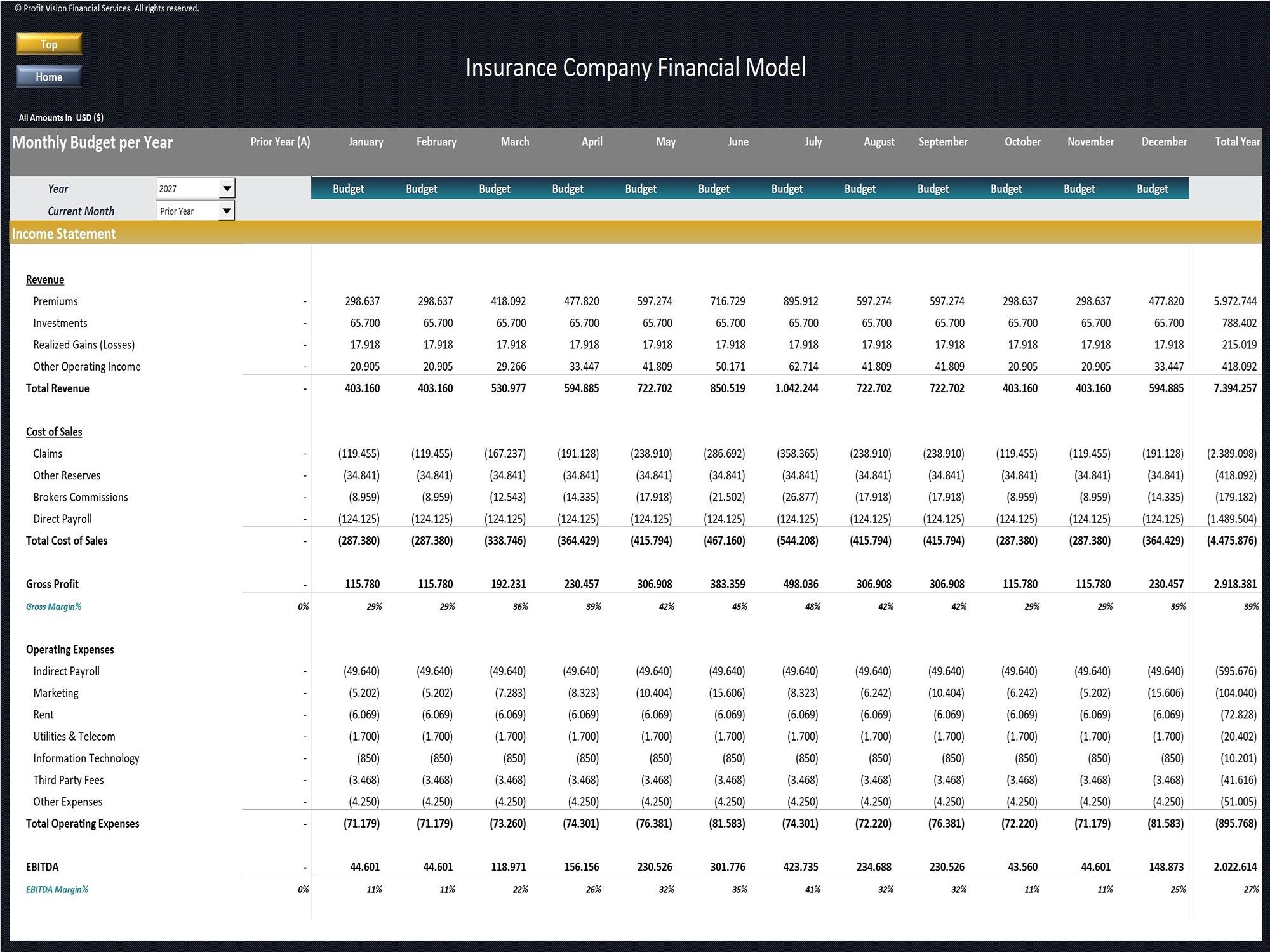

It includes assumptions and calculations of total insurance policies for 5 different insurance types (Life, Health, Disability, Home and Auto), revenue sources (premiums, investments, etc.), Directs Costs (Claims, Brokers Commissions, etc.), Direct and Indirect Payroll plan (headcount, salaries, commissions, bonus, etc.), Operating Expenses, Capital Expenditures, business Financing assumptions through Debt & Equity and Valuation multiples and exit assumptions in case of a potential future sale.

Model Structure

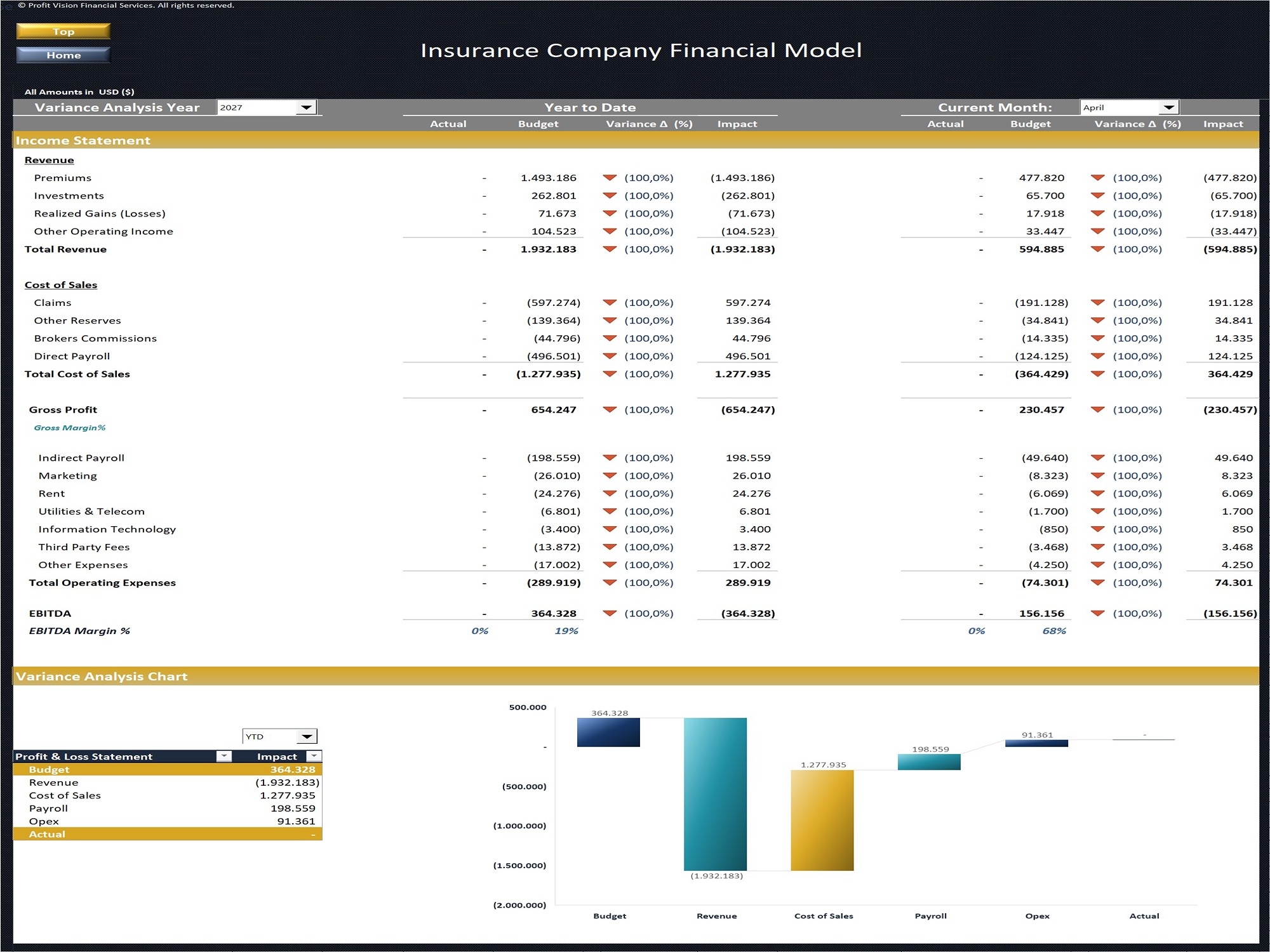

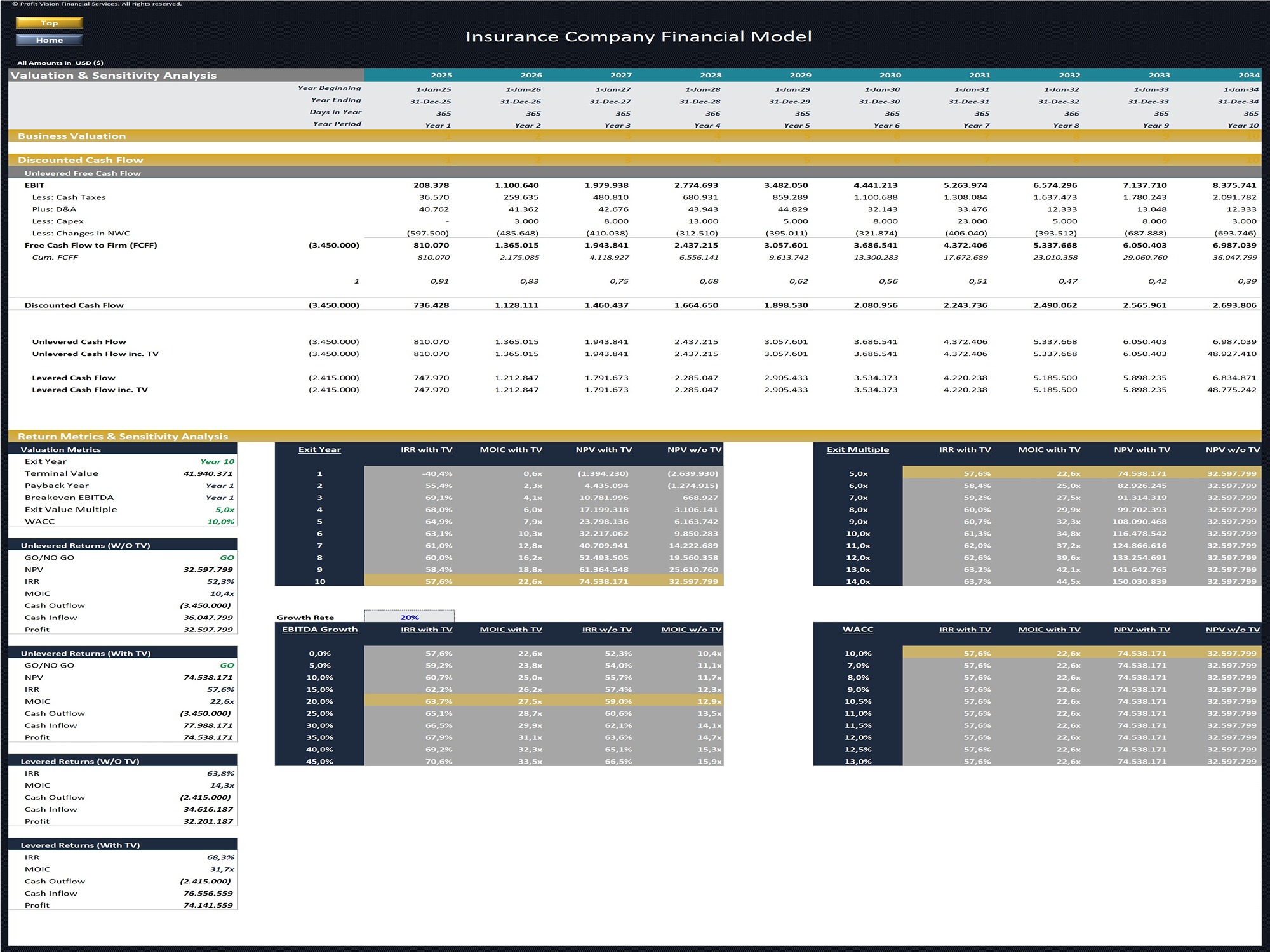

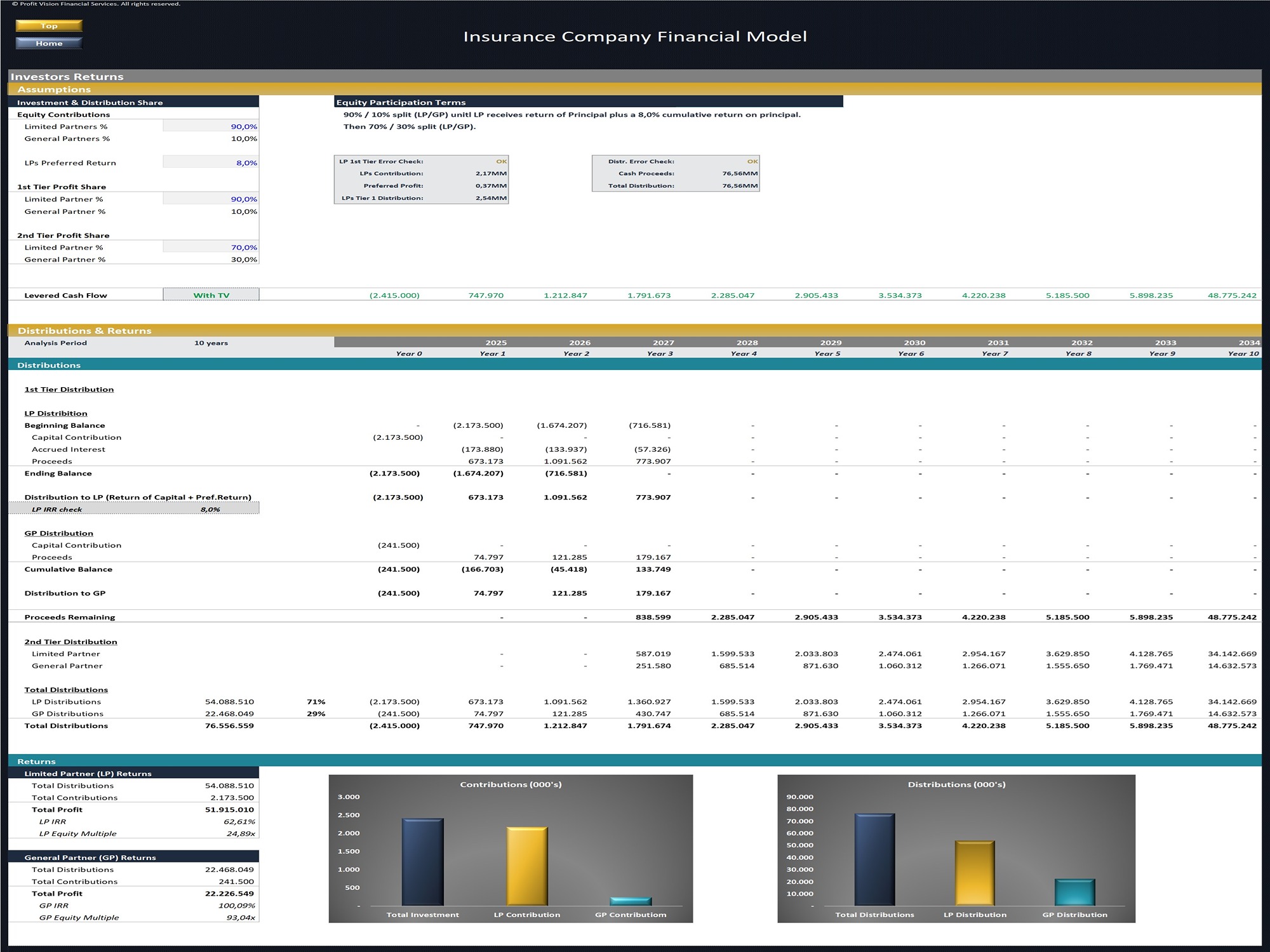

The template’s outputs include Monthly Budget, Variance Analysis, Annual Forecasted Financial Statements (3 Statement Model), Annual Direct Cash Flow, Breakeven Analysis, Business Valuation and Investors Returns Waterfall. A variety of KPIs and Financial Ratios analyzes business performance and the company’s results are presented through sophisticated charts & graphs and are summarized on a professional Executive Dashboard.

The models follows Financial Modeling Best Practices and is fully customizable.

Instructions on the use of the model are included in the Excel file.

Inputs:

- General Business Info

- Insurance Contracts Assumptions (Total Contracts, Cancellations Rate, Premium per type, etc.)

- Other Revenue Sources (Investments, realized gains, etc.)

- Direct Costs Assumptions (Claims, Brokers Commissions, etc.)

- Payroll, OPEX & CAPEX Assumptions

- Operating Scenarios

- Financing & Capital Structure – Uses & Sources of Cash analysis (Financing through Equity & Debt)

- Exit Year Scenario & Valuation Multiples

Output Reports:

- Monthly Budget and Actual Reports

- Budget Summary per Year

- Budget vs. Actual Variance Analysis at a YTD and Monthly level

- Annual Financial Statements (3 Statement model

- Direct Cash Flow

- Break-Even Analysis

- KPIs & Financial Ratios, including several Profitability, Efficiency, Liquidity, and Leverage (Solvency) Ratios

- Performance Dashboard

- Business Valuation, including DCF Model, Return Metrics (NPV, EV, IRR, MOIC, ROI, etc.), and Sensitivity Analysis

- Investors Returns Waterfall Model

- Dynamic Professional Executive Summary with an option to choose the Exit Year and Exit Scenario (with or without Terminal Value)

Help & Support

Committed to high quality and customer satisfaction, all our templates follow best-practice financial modeling principles and are thoughtfully and carefully designed, keeping the user’s needs and comfort in mind.

Whether you have no experience or are well-versed in finance, accounting, and the use of Microsoft Excel, our professional financial models are the right tools to boost your business operations!

If you experience any difficulty while using this template and cannot find the appropriate guidance in the provided instructions, please feel free to contact us for assistance.

If you need a template customized for your business requirements, please e-mail us and provide a brief explanation of your specific needs.

Shipping Policy

Your files will be available to download once payment is confirmed.

Refund Policy

Our documents are customizable templates and we understand that they might not suit everyone. You can preview them by clicking the 'Preview' button to ensure they meet your needs.

If you have questions or need more information, please contact us before purchasing.

Because our products are digital we can't accept returns or issue refunds once you've downloaded a document. Please preview and ask questions before buying.

If you need customization of the downloaded template, please email us and provide a brief explanation of your specific needs.

Cancellation / Return / Exchange Policy

Instant download items (digital products) don’t accept returns, exchanges or cancellations. Please contact us about any problems with your template.

General Inquiries

There are no inquiries yet.

Reviews

There are no reviews yet.