Real Estate PE Multiple Hurdles Waterfall Model

$ 69

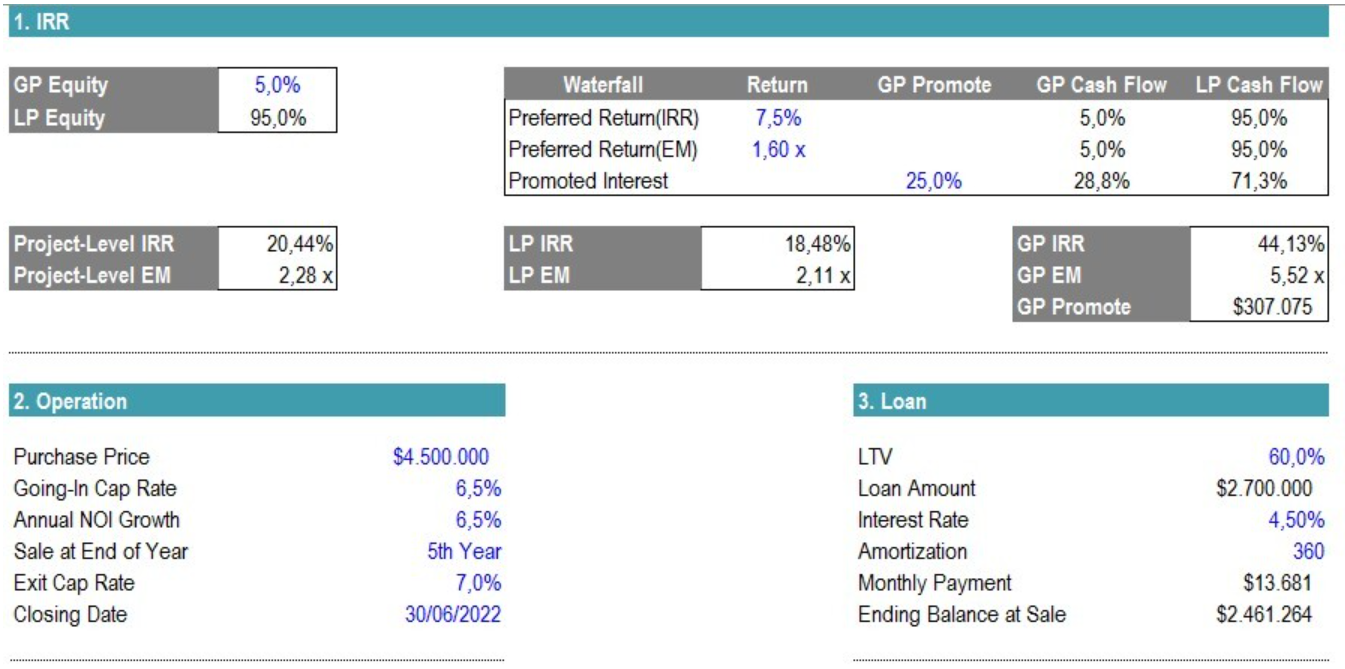

What sets our model apart is the exclusive consideration of both hurdles simultaneously. Unlike traditional models that solely focus on a single benchmark, our approach ensures that the General Partner’s extra promote interest is earned only when both the Preferred IRR and Equity Multiple targets are met. This unique feature elevates the precision of your analysis, making it an invaluable asset for assessing complex real estate investment opportunities.

Real Estate PE Multiple Hurdles Waterfall Model Key Features and Benefits

Unmatched Accuracy

Real Estate PE Multiple Hurdles Waterfall Model enables you to calculate waterfall distributions with exceptional precision, accurately reflecting the financial dynamics of your investment. By incorporating two hurdles, it delivers a more nuanced understanding of the investment’s performance.

Comprehensive Analysis

Evaluate investment scenarios from various angles by considering both the Preferred IRR and Equity Multiple. Gain deeper insights into the potential rewards associated with your real estate ventures.

Flexibility and Customization

Tailor the model to suit your specific investment requirements and adapt it effortlessly to unique deal structures. This flexibility ensures compatibility with a wide range of investment strategies and scenarios. (Data in color can be customized to suit your particular project.)

Streamlined Decision-Making

Make informed decisions swiftly and confidently, armed with reliable projections and metrics derived from our model’s robust calculations. Minimize risks and optimize your investment strategy.

Investor-Ready Model

Generate comprehensive model and visualizations with ease, simplifying complex concepts and enhancing communication with stakeholders. Effectively convey the value and potential of your investment proposals.

Time-Saving Efficiency

Our user-friendly design enables you to navigate the model seamlessly, significantly reducing the time spent on manual calculations. Focus your energy on analyzing investment performance rather than getting lost in spreadsheets.

Highly Dynamic

Users can easily tailor the model by simply modifying the inputs of the assumption to suit their real purpose.

Application of Financial Modeling Best Practices

The model is ready-to-use and well-structured based on the Best Practice of Financial Modeling and utilizes a One-Page Model style that facilitates users to easily follow the logic of the model and understand the formula of the calculation without the need of switching from sheet to sheet.

Simplicity

The template is greatly user-friendly for both professional analysts and users with little experience in financial modeling, thanks to its simple design pattern and easy-to-follow logic.

User Satisfaction Guaranteed

To guarantee user satisfaction, the model does not use complicated formulas or VBA code. The structure and content have been created following the Best Dashboard Principles and prioritize flexibility and user-friendliness.

Model Structure

- TOC – Table of Content

- Model:

- Important Notes of Model

- IRR & Equity Multiple

- Operation Inputs

- Loan Inputs

- Waterfall Analysis Model

- Charts

- Support

Customer Support

Please feel free to contact us if you experience any problems when using the models provided. In addition, if you need a customized model for your specific business, please let us know—we would be happy to help you.

Final Note

Don’t let complex real estate investments overwhelm you. Our Real Estate Waterfall Analysis Model is your gateway to unlocking the hidden potential of your ventures and maximizing returns. Empower your decision-making with accuracy, efficiency, and unparalleled insights. Visit our website now and embark on a transformative journey in private equity and investor analysis. Invest in success!

General Inquiries

There are no inquiries yet.

Reviews

There are no reviews yet.